How telematics in insurance industry make an impact and helps to modernize it

Introduction

- Telematics in the insurance sector has constantly changed established procedures, pushing innovation and improving client experiences. Telematics has emerged as a game changer among these technologies, transforming how insurers assess risk, adjust coverage, and interact with policyholders across industries. But what is telematics, and how does it work? In this research, we will dig into the complexities of telematics technology and its tremendous influence on several parts of the insurance market. Telematics has a wide-ranging impact on car, health, commercial, and life insurance, paving the way for more accurate risk assessment, personalized coverage alternatives, and proactive risk management measures. Join us as we uncover the workings of telematics and its dramatic influence on insurance.

How Telematics works in Real Life

-

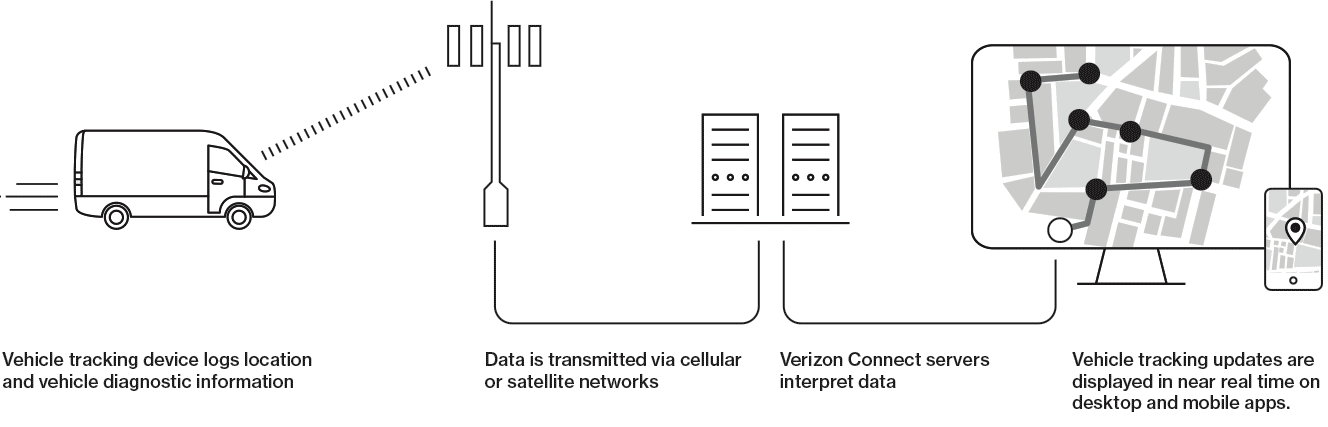

Source :- https://www.verizonconnect.com/resources/article/what-is-telematics/

-

GPS Modul: This device receives signals from GPS satellites and determines the vehicle's location (latitude and longitude). It's depicted as a small box with the letters "GPS" inside.

-

Cellular Modem: This component transmits the GPS data and other vehicle information to a central server using a cellular network. It's shown as a box with the label "Cellular Modem." Central Server: This server stores and processes the data received from the vehicle. A large server icon represents it.

-

Vehicle Sensors: These sensors collect various data points about the vehicle's operation, such as engine speed, fuel level, and door open/close status. They're shown as small circles or squares connected to the vehicle icon.

-

Software Platform: This software allows users to view and analyze the vehicle data on a computer or mobile device. It's not directly shown in the diagram but implied by the ability to view data on a computer screen.

A real-life example of how telematics benefits insurance policy purchaser

- Sarah, a careful driver prioritizing safety, thought her basic insurance was excessive. She chose a telematics insurance policy and put a gadget in her car to monitor mileage, time of day, speed, and driving smoothness. After a trial, her cautious behaviors, including modest miles, avoiding rush hour, and keeping moderate speeds, resulted in a large reduction. Sarah's careful driving was rewarded with telematics, making her insurance more equitable and cost-effective and promoting safer driving. While privacy issues remain, anonymized data usage and potential advantages for drivers and insurers indicate that telematics might be the future of personalized insurance.

Benefits of using telematics in insurance industry

1. Accurate Risk Assessment

- Traditional insurance pricing models frequently use demographic data to measure risk, which leads to wide generalizations. However, telematics enables insurers to collect real-time data on individual driving behavior, allowing for a more exact risk assessment. By analyzing parameters such as speed, acceleration, braking habits, and distance, insurers may adapt rates to match an individual's actual risk, resulting in more equitable pricing.

2. Improved Claims Management

- Telematics data might offer helpful information in the case of a dispute. By analyzing data acquired before an occurrence, insurers can better grasp the circumstances that led up to. it, thereby speeding up the claims process and decreasing disputes. Telematics can also assist insurers in discovering false claims by cross-referencing data acquired with the reported occurrence.

3. Promotion of Safe Driving:

- One of the most significant advantages of telematics is its capacity to encourage safe driving habits. Many insurers provide discounts or benefits to customers who practice safe driving behaviors, such as following speed limits, avoiding hard braking, and driving during off-peak hours. Telematics minimizes the incidence of accidents while also instilling a sense of responsibility on the road.

4. Enhanced Customer Engagement

- Telematics-enabled insurance plans frequently include mobile applications or web portals that allow policyholders to track their driving habits and receive real-time feedback. This improved openness and participation enables consumers to control their insurance prices by making educated decisions regarding their driving behaviors. Furthermore, insurers may use this direct contact route to give personalized assistance and services, therefore improving the relationship with their consumers.

5. Environmental Benefits:

- Telematics also helps with environmental sustainability by encouraging eco-friendly driving behaviors. Insurers may monitor fuel economy and idle time, rewarding policyholders who practice ecologically friendly driving habits. This lowers carbon emissions and coincides with larger societal initiatives to combat climate change.

How Telematics Make an impact in the Different Insurance sector

1. Auto Insurance

- Telematics has significantly impacted motor insurance, notably in risk assessment and pricing. Insurers can improve their understanding of individual drivers' risk profiles by collecting real-time data on driving behavior, such as speed, acceleration, braking patterns, and distance. This enables more accurate pricing, with premiums customized to real driving patterns rather than merely based on demographics. Telematics also encourages safer driving behaviors by offering awards and savings to policyholders with responsible driving practices. In this way, telematics in insurance industry make an impact.

2. Home Insurance

- Telematics technology is changing how home insurance companies analyze risks and avoid losses. Smart home gadgets paired with sensors and security cameras may detect possible threats such as water leaks, fires, and unauthorized entrances. By analyzing data from these devices, insurers may identify and manage hazards ahead of time, lowering the possibility of claims and property damage. Furthermore, telematics allows insurers to provide more tailored coverage alternatives based on individual homeowners' risk profiles and investments in smart home technologies. In this way telematics in insurance industry make an impact.

3. Health Insurance

- Telematics can transform health insurance by encouraging preventative care and wellness activities. Wearable gadgets and health-tracking applications may collect information about people's activity levels, sleeping habits, and vital indicators. This information may be used to encourage healthy habits through reward programs and personalized wellness strategies. Telematics also helps insurers to track and monitor chronic illnesses more carefully, resulting in earlier intervention and improved health outcomes. In this way telematics in insurance industry make an impact.

4. Commercial Insurance

- Telematics technology is transforming risk management techniques in a variety of businesses, including commercial insurance. Fleet telematics, for example, enables commercial vehicle operators to track driver behavior, optimize routes, and manage vehicle maintenance schedules. This increases operating efficiency and lowers the likelihood of accidents and insurance claims. Telematics also allows insurers to provide usage-based insurance plans suited to business clients' unique needs, such as pay-as-you-drive or pay-how-you-drive coverage alternatives. In this way telematics in insurance industry make an impact.

5. Life Insurance

- While less widespread, telematics is influencing the life insurance industry as well. Wearable gadgets and health tracking applications can offer insurers useful information about policyholders' lifestyles and general health conditions. This data may be used to better assess risk and provide personalized life insurance plans with premiums depending on people's health and wellness habits. Furthermore, telematics may encourage healthy behaviors through incentive programs and wellness initiatives, resulting in better health outcomes and lower insurance costs. In this way telematics in insurance industry make an impact.

Conclusion

In conclusion, telematics in the insurance sector is a revolutionary force profoundly altering how insurers assess risk, personalize coverage, and interact with policyholders. Telematics allows insurers to acquire deeper insights into individual risk profiles and provide more personalized insurance solutions by collecting and analyzing real-time data on driving behavior, property conditions, health measurements, and other factors. Telematics has an influence on several sectors of the insurance industry:

-

Telematics in vehicle insurance has resulted in fairer pricing and incentives for better driving practices, ultimately lowering accidents and claims.

-

Telematics-driven risk assessment and loss prevention initiatives in the home insurance industry have improved property protection and enabled more customized policy alternatives.

-

Telematics promotes preventative treatment and wellness activities in health insurance, which leads to better health outcomes and lower insurance costs.

-

Telematics in commercial insurance optimizes fleet management and provides usage-based coverage choices customized to firms' unique needs.

-

Life insurance increasingly uses telematics to estimate risk and incentivize healthy behaviors.

Overall, telematics in the insurance business has significantly influenced innovation, increased efficiency, and improved client experiences. As technology advances, the potential for telematics to significantly transform insurance practices and results across all sectors remains high. By leveraging data and technology, insurers can continue adapting and growing in an increasingly dynamic and competitive world, benefiting insurers and policyholders.