Telematics In Health Insurance: A Path to Personalized Wellness

Introduction

- Telematics in health insurance has been making big waves, reshaping the old-school ways we think about coverage. While we often hear about it in car insurance, telematics is also breaking new ground in health insurance. By tapping into data from wearable gadgets, smartphone apps, and other intelligent health devices, insurance companies are diving deep into understanding how their customers live and care for themselves. This blog looks at how telematics could be the game-changer in health insurance, tackling the current challenges and opening doors to a more personalized approach to staying healthy.

Pain Points in Traditional Health Insurance:

1. Lack of Personalization

- Traditional health insurance policies frequently provide one-size-fits-all coverage, failing to address customers' unique requirements and behaviors. This causes inefficiencies and inequities in coverage, leaving many people without enough support for their specific health journeys.

2. Limited Risk Assessment:

- Without real-time health data, insurers fail to analyze policyholder risk profiles appropriately. This results in generalized pricing systems that do not reflect an individual's health state or behaviors, affecting premiums and coverage alternatives.

3. Reactive Approach to Wellness

- Traditional health insurance approaches are more likely to be reactive than proactive in encouraging well-being. Insurers often act only when a health problem occurs, resulting in missed chances for preventative treatment and early intervention.

4. Limited Engagement

- Traditional health insurance arrangements frequently struggle to involve customers in their health management. Individuals who do not receive personalized feedback or incentives for healthy behaviors may feel detached from their insurance providers and less motivated to prioritize their health.

5. High Administrative Costs

- Traditional health insurance systems are frequently saddled with significant administrative expenses, which include paperwork, claims processing, and customer support. These inefficiencies might result in higher consumer rates and worse overall satisfaction with their insurance experience.

6. Fragmented Healthcare Ecosystem

- The healthcare ecosystem is frequently fragmented, with little communication and coordination among insurers, providers, and patients. This lack of integration can result in gaps in care, duplicate services, and poor health outcomes.

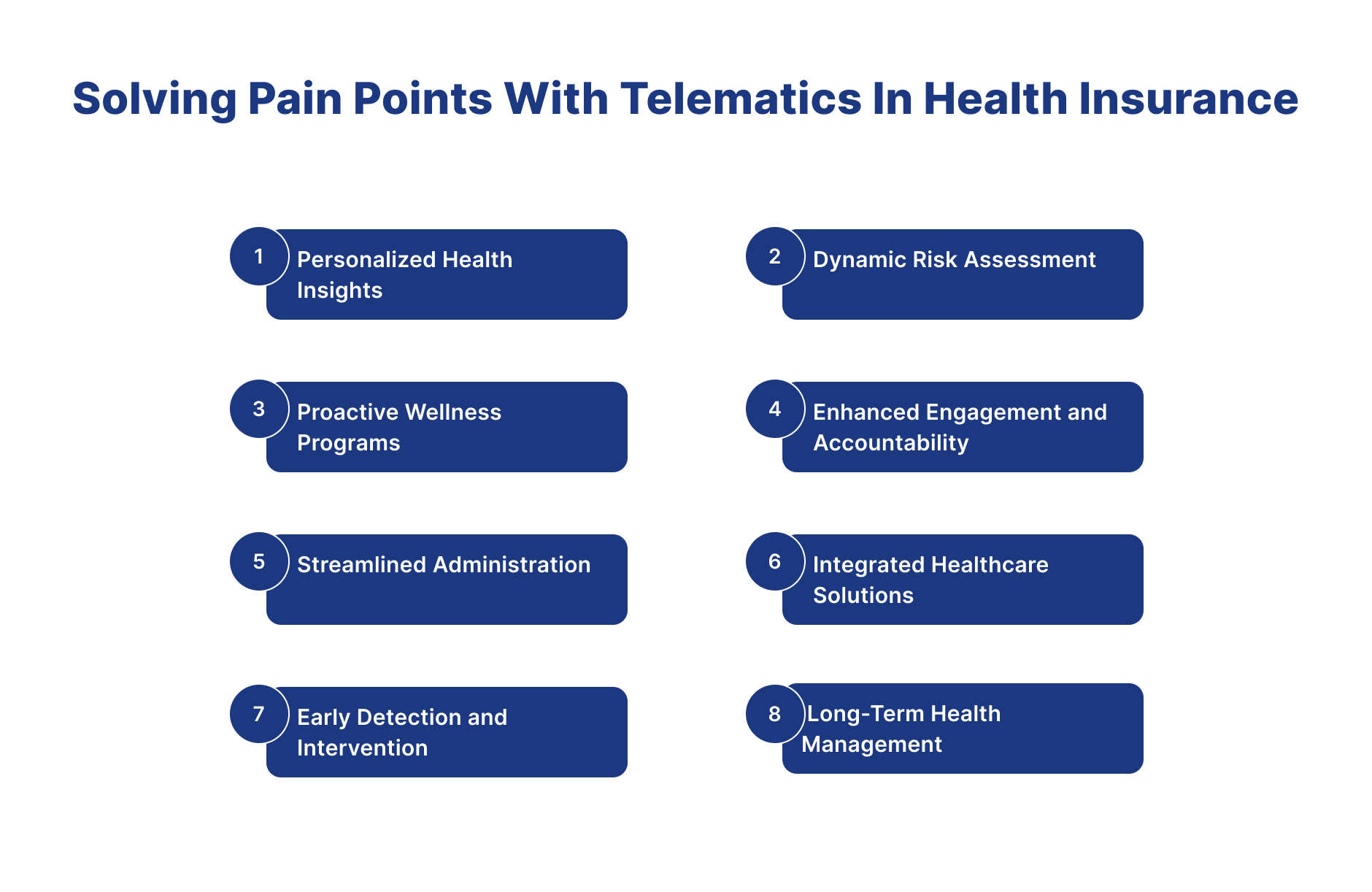

Solving Pain Points with Telematics in Health Insurance:

1. Personalized Health Insights

- Telematics in health insurance enables insurers to collect detailed information on policyholders' health behaviors, such as exercise levels, sleep patterns, and vital signs. By analyzing this data, insurers may adjust coverage plans and wellness programs to each individual's unique needs, fostering a more personalized and holistic approach to healthcare.

2. Dynamic Risk Assessment

- With real-time health data, insurers may improve risk assessment models, precisely detecting health hazards and forecasting future health consequences. This allows insurers to alter rates and incentives based on a person's health state and behaviors, resulting in a more equitable and transparent insurance system. In this way, telematics in health insurance can improve risk assessment.

3. Proactive Wellness Programs

- Telematics in health insurance enables proactive wellness campaigns emphasizing preventative care and lifestyle management. Insurers may use data-driven insights to deliver personalized wellness advice, incentivize healthy behaviors, and provide early intervention techniques, allowing policyholders to take charge of their health and well-being.

4. Enhanced Engagement and Accountability

- Telematics in health insurance increases policyholder participation and accountability by giving real-time feedback on health behaviors and progress toward wellness goals. Through interactive platforms and personalized incentives, insurers may encourage people to maintain their health and maximize their insurance benefits actively.

5. Streamlined Administration

- Telematics in health insurance simplifies administrative operations by decreasing paperwork, automating claims processing, and improving customer support via digital channels. Insurance companies may enhance operational efficiency, cut administrative expenses, and pass savings on to policyholders by employing data analytics and AI-powered solutions.

6. Integrated Healthcare Solutions

- Telematics promotes deeper integration and cooperation in the healthcare ecosystem by linking insurers, providers, and patients via interoperable platforms and shared data insights. This seamless flow of information allows for more coordinated care delivery, personalized treatment regimens, and improved patient health outcomes.

7. Early Detection and Intervention

- Telematics in health insurance allows for early diagnosis of health disorders by continuously monitoring vital signs, symptoms, and trends. Insurers may use predictive analytics and machine learning algorithms to anticipate future health concerns, intervene early with tailored therapies, and avoid costly medical crises or problems.

8. Long-Term Health Management

- Telematics in health insurance allows for early diagnosis of health disorders by continuously monitoring vital signs, symptoms, and trends. Insurers may use predictive analytics and machine learning algorithms to anticipate future health concerns, intervene early with tailored therapies, and avoid costly medical crises or problems.

Conclusion

- In conclusion, using telematics technology in health insurance signals a significant change toward a more personalized and proactive approach to healthcare. Insurers may obtain significant insights into consumers' lives and health behaviors by leveraging data from wearable devices, smartphone applications, and other linked health technology. This enables personalized coverage plans, proactive wellness programs, and early intervention techniques, eventually allowing policyholders to take charge of their health and well-being. As telematics evolves and shapes the landscape of health insurance, it has the potential to improve health outcomes, lower costs, and encourage a healthier society overall.