How Telematics in Auto Insurance Will Transform Auto Insurance

Introduction

- Telematics in auto insurance has seen significant changes in recent years. These devices, which combine communication and computer technology, completely alter how insurance companies determine how much to charge for coverage. Instead of guessing based on age and gender, these gadgets monitor factors like how fast you drive, how you stop, and when you're on the road. This implies that insurance firms may provide more personalized prices based on how safe—or risky—your driving habits are. And it's not just about saving money; knowing this data might help us be more conscious of our driving and possibly even safer on the road, which could mean fewer accidents in the long run. In this blog, we will explore how telematics in auto insurance will modernize it.

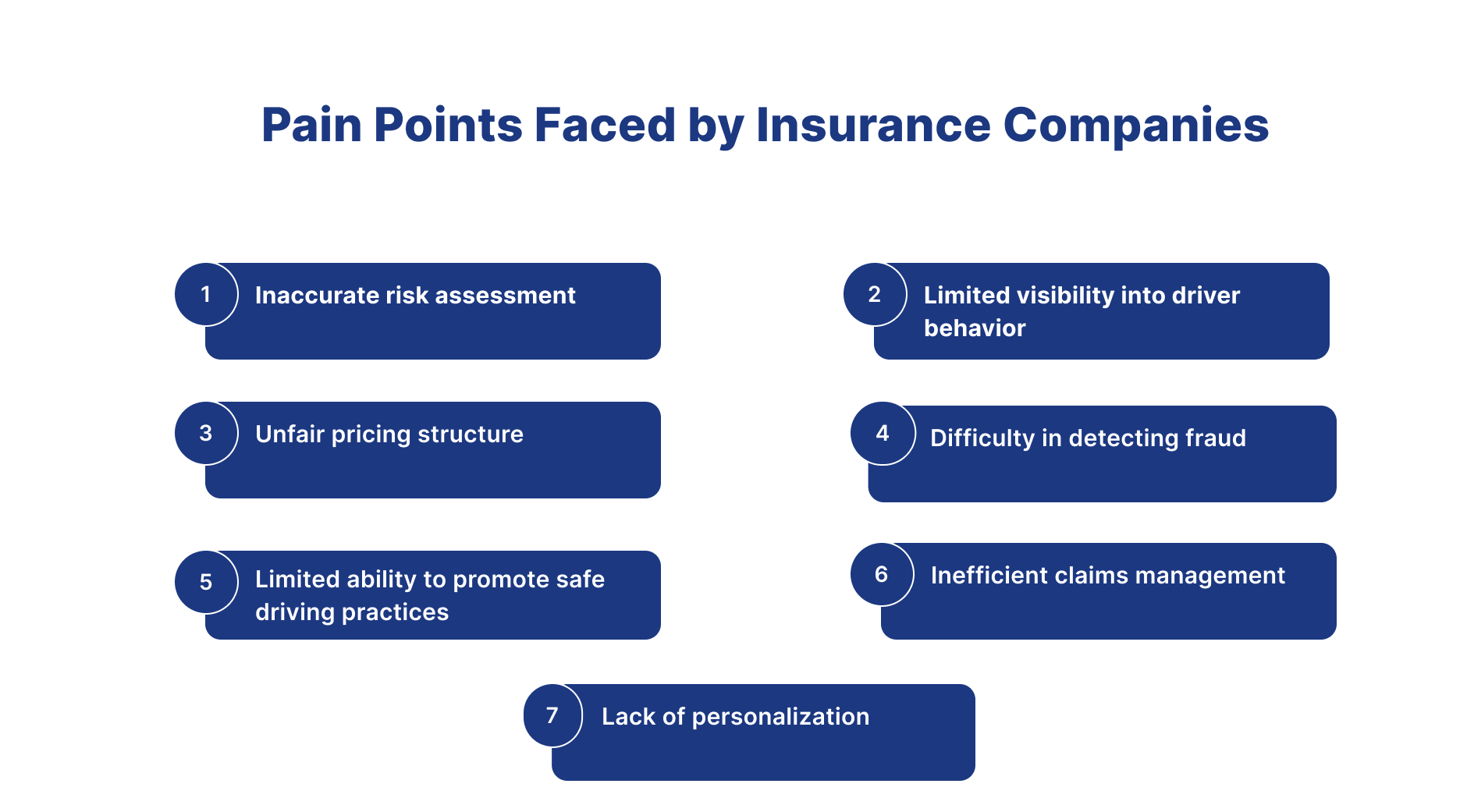

Pain Points Faced by Insurance Companies

Inaccurate risk assessment

- Insurance firms have long struggled with the difficult issue of accurately assessing individual drivers' risk profiles. The problem is that the old-school grading systems they've been using rely primarily on broad statistics and historical data, leaving them in the dark about what's occurring on the roadways in real-time. So, they're simply making educated predictions based on past trends rather than having a clear picture of how someone drives daily.

Limited visibility into driver behavior

- Insurance firms failed to understand how individuals drove. They largely relied on what drivers told them, which was not always accurate. You know how it is: sometimes people forget or don't want to confess they aren't the safest drivers. This made it difficult for insurance firms to provide plans tailored to an individual's driving style. They were stuck with generic information that didn't always fit reality.

Unfair pricing structure

- Traditional vehicle insurance has long been chastised for its ineffective pricing structure. Many cautious drivers paid outrageous rates because insurers lacked precise data and personalized risk assessment methodologies. On the other hand, riskier drivers frequently received cheaper premiums while posing a bigger liability. This mismatch resulted in a system in which conscientious drivers were penalized with greater premiums, while riskier drivers benefited from lower coverage. What was the result? An unfair pricing system that fails to account for individual driving behaviors, leaving many policyholders feeling unfairly treated.

Difficulty in detecting fraud

- Insurance firms found themselves with the arduous job of detecting false claims. The lack of reliable data presented a substantial challenge, making it extremely difficult to determine the veracity of claimed instances.

Limited ability to promote safe driving practices

- Insurance firms struggled to promote safe driving behaviors among their policyholders due to a lack of real-time driving behavior data. This shortcoming prevented them from properly encouraging or incentivizing safer driving practices. As a result, accident rates remained high, increasing expenses for insurers and policyholders.

Inefficient claims management

- Insurance firms have frequently found themselves dealing with the complications of claims handling due to a lack of real-time data on driving behavior and accident information. This shortage has caused a plethora of issues, including claims processing delays, increased administrative costs, and, ultimately, lower levels of consumer satisfaction.

Lack of personalization

- Previously, insurance firms used a one-size-fits-all strategy. They considered your age, gender, and location before paying your insurance premium. The issue was that it didn't take into consideration how you drove. So, even if you are a highly cautious driver who always follows the laws, you will still pay the same as someone a little more... let's say, adventurous behind the wheel. It simply didn't seem fair.

How Telematics In Auto Insurance Can Modernize It

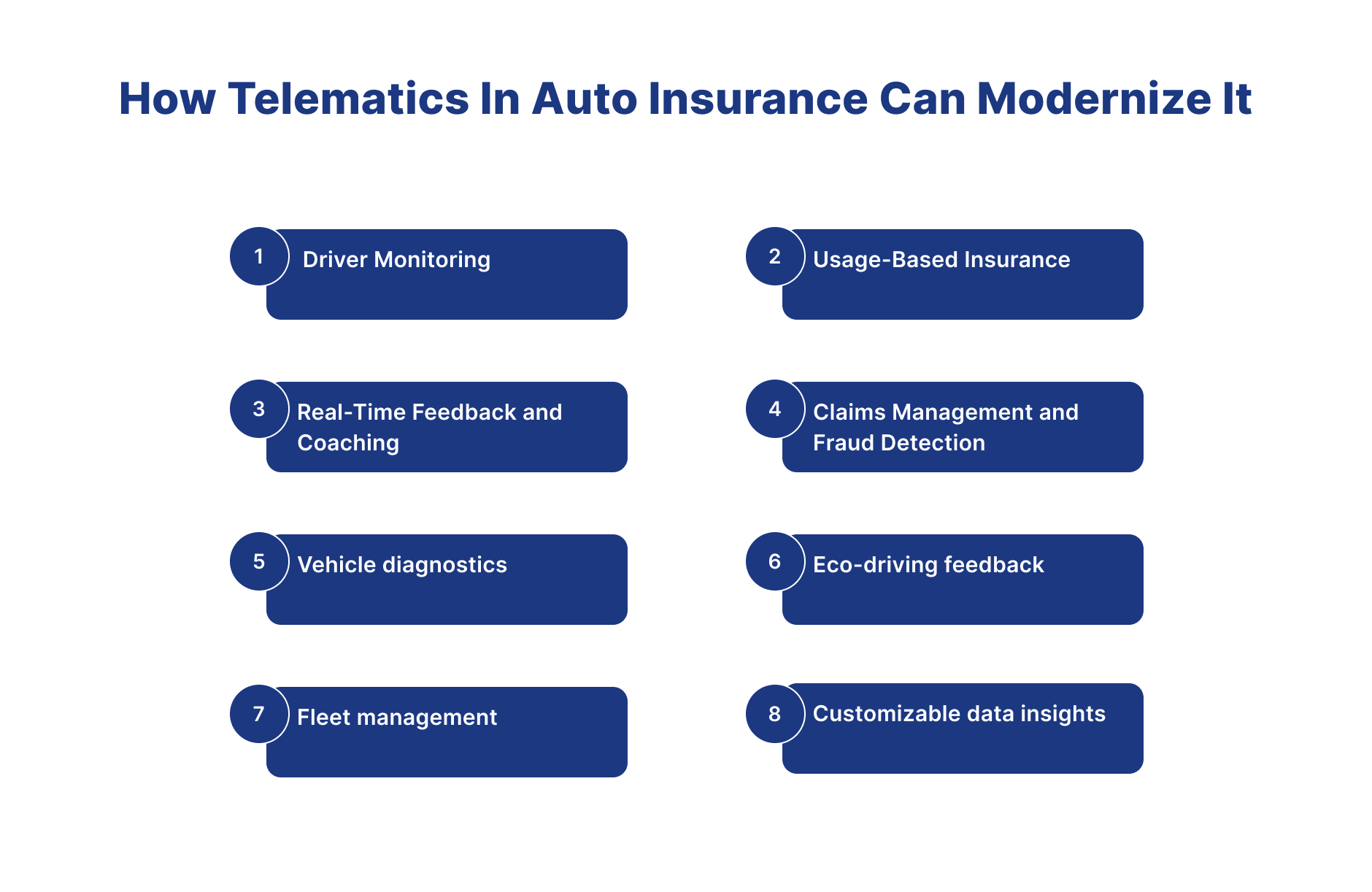

Driver Monitoring

-

Telematics equipment is like silent guardians of the road, always monitoring how we drive. They are continually recording everything we do, from how rapidly we accelerate to how softly we brake and even the distance we go. With this wealth of information, insurance firms have a front-row seat to our driving behaviors, providing a clear picture of the hazards behind the wheel.

-

Armed with this intelligence, insurers may abandon the one-size-fits-all approach and instead personalize coverage to our real driving behaviors. So, if you're the driver who stays under the speed limit, slows softly, and drives fewer miles, you could find yourself enjoying those delicious, sweet, premium savings.

Usage-Based Insurance

- Telematics devices enable usage-based insurance models in which premiums are directly proportional to how often and well a vehicle is driven. Safe drivers who drive fewer miles or practice safe driving can get lower premiums, making insurance more reasonable and equitable. In this way, insurance companies can use telematics in auto insurance.

Real-Time Feedback and Coaching

-

Telematics devices provide drivers instant feedback on their driving patterns, allowing them to discover areas where they may improve. abilities and adopt safer driving practices. Consider getting real-time warnings or suggestions to help you achieve smoother braking, more controlled acceleration, and adherence to speed restrictions. This technology can help individuals become better drivers and act as an effective tool for insurers to build a safety culture.

-

Consider this: insurance firms provide coaching sessions and incentives to policyholders who continuously display safe driving behavior. It's a win-win situation: drivers become more attentive behind the wheel, while insurers see a concrete drop in the number and severity of accidents, leading to cheaper premiums and safer roads for everyone. In this way, using telematics in auto insurance companies can get feedback about the driver.

Claims Management and Fraud Detection

-

Telematics devices are critical for monitoring driving behavior, claims administration, and fraud detection. When an accident occurs, these sensors collect precise data that insurers may utilize to quickly assign liability and assess the level of damage, making the claims process faster and more efficient.

-

Furthermore, the continuous flow of real-time data from telematics devices allows insurers to identify anomalies between reported events and actual driving data, which aids in discovering false claims. This capacity improves the integrity of the insurance system by guaranteeing that honest policyholders are treated fairly and avoiding exploitation of the claims process. In this way, telematics in auto insurance can be used by insurance companies in claim management and fraud detection.

Vehicle Diagnostics

- Telematics devices provide a significant benefit by monitoring the health and performance of your car. They accomplish this by giving real-time diagnostics and notifying users if possible maintenance concerns arise. It's like having your personal vehicle doctor who alerts you before something goes wrong. This proactive approach is handy; it may save you time and money in the long run. After all, nobody likes dealing with unexpected failures or paying a high price for repairs that might have been avoided. In this way, telematics in auto insurance can be used in vehicle diagnostics.

Eco-Driving Feedback

- Some telematics systems give information on eco-driving practices, such as excessive idling or rapid acceleration. This feedback encourages policyholders to practice more fuel-efficient and ecologically responsible driving habits. In this way, telematics in auto insurance can be used by insurance companies for eco-driving feedback.

Fleet Management

- Telematics devices are also used extensively in fleet management applications. Insurance businesses get insights into risk management and fleet operations by leveraging the data they gather. This translates into concrete benefits like increased productivity, improved fuel economy, and decreased maintenance costs.in this way, telematics in auto insurance can help insurance companies gather data.

Customizable Data Insights

- Telematics systems provide a flexible approach, allowing insurance firms to adapt their data analysis to specific metrics or risks. This customization enables insurers to look deeper into the data, resulting in more valuable insights that support informed decision-making. By focusing on key areas of driver behavior or vehicle usage, insurers may improve their goods and services to suit their customers' demands better. In this way, telematics in auto insurance can help insurance companies gather and analyze data.

Conclusion

- In conclusion, telematics in auto insurance addresses a variety of difficulties that insurers face. Using advanced data analysis and real-time insights, Telematics systems provide more precise risk ratings, tailored insurance policies, and improved client interactions. Furthermore, they deliver various benefits, like proactive accident avoidance, improved fleet management, and coaching on environmentally beneficial driving behaviors. Using these advantages, insurance companies may expand their services, save costs, and reduce risks. As the use of telematics grows, insurance firms that embrace this technology will prosper in a dynamic environment, assuring their long-term competitiveness.