5 Ways To Implement AI For Better Customer Service In The Fintech Industry

The era of AI for Better Customer Service is here, so be ready to go to a place where cutting-edge technology meets unmatched client experiences

Introduction

- Businesses must look into creative ways to provide outstanding customer service in a world where consumer expectations are greater than ever. Enter artificial intelligence (AI), which has the potential to completely change how businesses communicate with and cater to their clientele. Artificial intelligence (AI) revolutionizes customer service with personalized suggestions, predictive analytics, and intelligent chatbots that provide immediate assistance. In this piece, we explore the fascinating ways artificial intelligence (AI) may be used to transform customer service and enable companies to go above and beyond for their clients and build enduring connections. The era of AI for Better Customer Service is here, so be ready to go to a place where cutting-edge technology meets unmatched client experiences.

-

Fintech customer service has undergone a paradigm change with the introduction of AI, moving from old reactive support models to proactive, anticipatory assistance. This is more than simply an improvement. Instead of replacing human customer service personnel, artificial intelligence (AI) enhances their skills to concentrate on high-value contacts. At the same time, AI takes care of repetitive duties and offers immediate support.

-

Every business customer is very important because they will generate the need, and the company needs to satisfy their needs by offering a product they are producing. Every company must focus on improving customer service because it develops its reputation in the customers' minds. With the help of AI for Better Customer Service, companies can improve, modernize, and automate it. AI can help the company provide on-time customer service, creating the company's positive reputation in customers' minds.

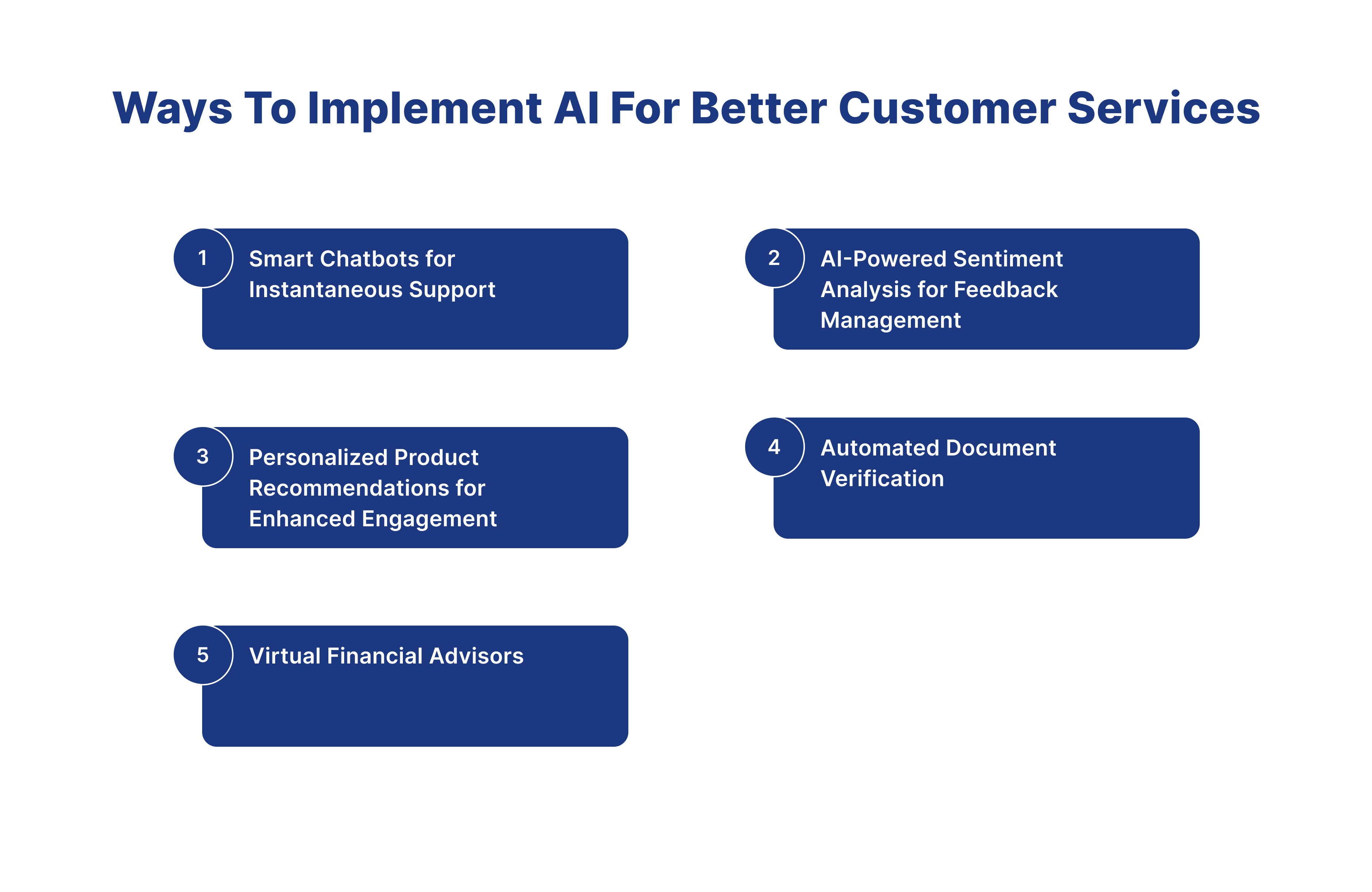

Ways to implement AI for better customer services

1.Smart Chatbots for Instantaneous Support

-The traditional customer services company needs to hire employees who can understand customer queries and provide a satisfying solution. The traditional customer service company can provide a service for a limited time hour. The traditional way is very time-consuming and costly, and when a company hires an employee, they need to train their employee every time, which can be too costly for the company.

- Implementing AI-powered chatbots is similar to having a virtual assistant for all client interactions, 24/7. These clever chatbots can answer common questions, give product details, and walk consumers through procedures while providing immediate assistance. This enhances reaction times and guarantees that clients get help anytime they need it, which promotes dependability and accessibility. this way Fintech companies can implement AI for Better Customer Service.

2.AI-Powered Sentiment Analysis for Feedback Management

-

Feedback is a very important part of the company. Every company has a separate department for feedback management; for this, the company needs to hire employees and give them training, which is very costly and time-consuming.

-

AI-driven sentiment analysis technologies combine user reviews, social media comments, and feedback to determine general sentiment. This makes it possible for fintech businesses to promptly reply to criticism and praise, showcasing their dedication to client pleasure and ongoing development. this way Fintech companies can implement AI for Better Customer Service.

3.Personalized Product Recommendations for Enhanced Engagement

-

In a traditional way for a personalized product recommendation, the company will analyze the data of the customer's product purchase, and based on that, the company will recommend it to the customer using the recommendation engine. Companies need to analyze the data manually, which is time-consuming and costly.

-

With transaction data and client preferences, AI algorithms may provide tailored product suggestions. This not only increases the opportunity for cross-selling and upselling, but it also demonstrates a thorough comprehension of the unique demands of each client. By customizing their solutions, fintech organizations may provide a more engaging and customer-centric experience. this way Fintech companies can implement AI for Better Customer Service.

4.Automated Document Verification

- If customers want to avail themselves of the fintech company, they will need to verify the document. To verify the customer's documents, the company needs to hire an employee to meet customers personally and verify their documents. The traditional process of document verification is very costly and time-consuming. Sometimes, an employee might verify the wrong customer document.

- If the company adopts AI in document verification, it will automate all the processes. Customers only need to upload their documents on the company's website, and based on the customer data, AI will verify the document on behalf of the employee. This will reduce the cost, time, and human effort. this way Fintech companies can implement AI for Better Customer Service.

5.Virtual Financial Advisors

-

As a physical financial advisor, the company needs to hire the employee. He will need to meet the customer to know all the personal data, and on the basis of that, the employee needs to give financial advice to the customer. Sometimes, there might be problems like location, language barriers, paperwork, etc..

-

If the company adapts AI for the financial advisor, then customers only need to give their data to the AI, and it will automatically analyze all the data; based on that data, AI will suggest the best financial plan to the customer. The employee did not need to meet the customer for this process so that location-related problems could be solved. And because of the automated process, cost and time will be reduced. this way Fintech companies can implement AI for Better Customer Service.

Conclusion

-

In conclusion, remarkable developments in customer service have been made possible by combining AI and the fintech sector. Financial institutions may provide clients with smooth, individualized, and practical experiences using AI technologies like chatbots, natural language processing, and predictive analytics. Artificial Intelligence (AI) can completely transform customer experience in the fintech sector by boosting fraud detection and prevention, enabling smooth transactions, and improving financial advising.

-

It is now imperative for fintech organizations to use AI-powered solutions to remain competitive and satisfy the changing needs of their clientele. So, why do you hesitate? It's time to use AI's promise and revolutionize customer service in the financial sector!

How Digiqt will help you to implement AI in customer services

-

At Digiqt, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients monthly updates on the software development progress.

-

Digiqt's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

What are 5 Ways To Implement AI For Better Customer Service In The Fintech Industry?

5 Ways To Implement AI For Better Customer Service In The Fintech Industry are AI-powered systems that automate and optimize processes using machine learning, natural language processing, and intelligent decision-making capabilities.

How do 5 Ways To Implement AI For Better Customer Service In The Fintech Industry work?

5 Ways To Implement AI For Better Customer Service In The Fintech Industry work by analyzing data, learning patterns, and executing tasks autonomously while integrating with existing systems to streamline operations and improve efficiency.

What are the benefits of using 5 Ways To Implement AI For Better Customer Service In The Fintech Industry?

The benefits include increased efficiency, reduced operational costs, improved accuracy, 24/7 availability, better customer experience, and data-driven insights for decision-making.