Telematics: A Win-Win for Insurers and Policyholders

Posted by Hitul Mistry

/22 Feb 24

Tagged under: #telematics,#insurance,#benefits

Introduction

- In today's era of fast technology advancement, the insurance industry is facing a significant transition, driven by the growth of telematics. This cutting-edge system uses real-time car data to assess driving habits, drastically changing the relationship between insurers and policyholders. it is more than simply premiums and claims; it's a game changer that benefits both parties. Throughout this blog, we'll look at how it is transforming insurance, reshaping traditional models to produce a win-win scenario for both insurers and policyholders.

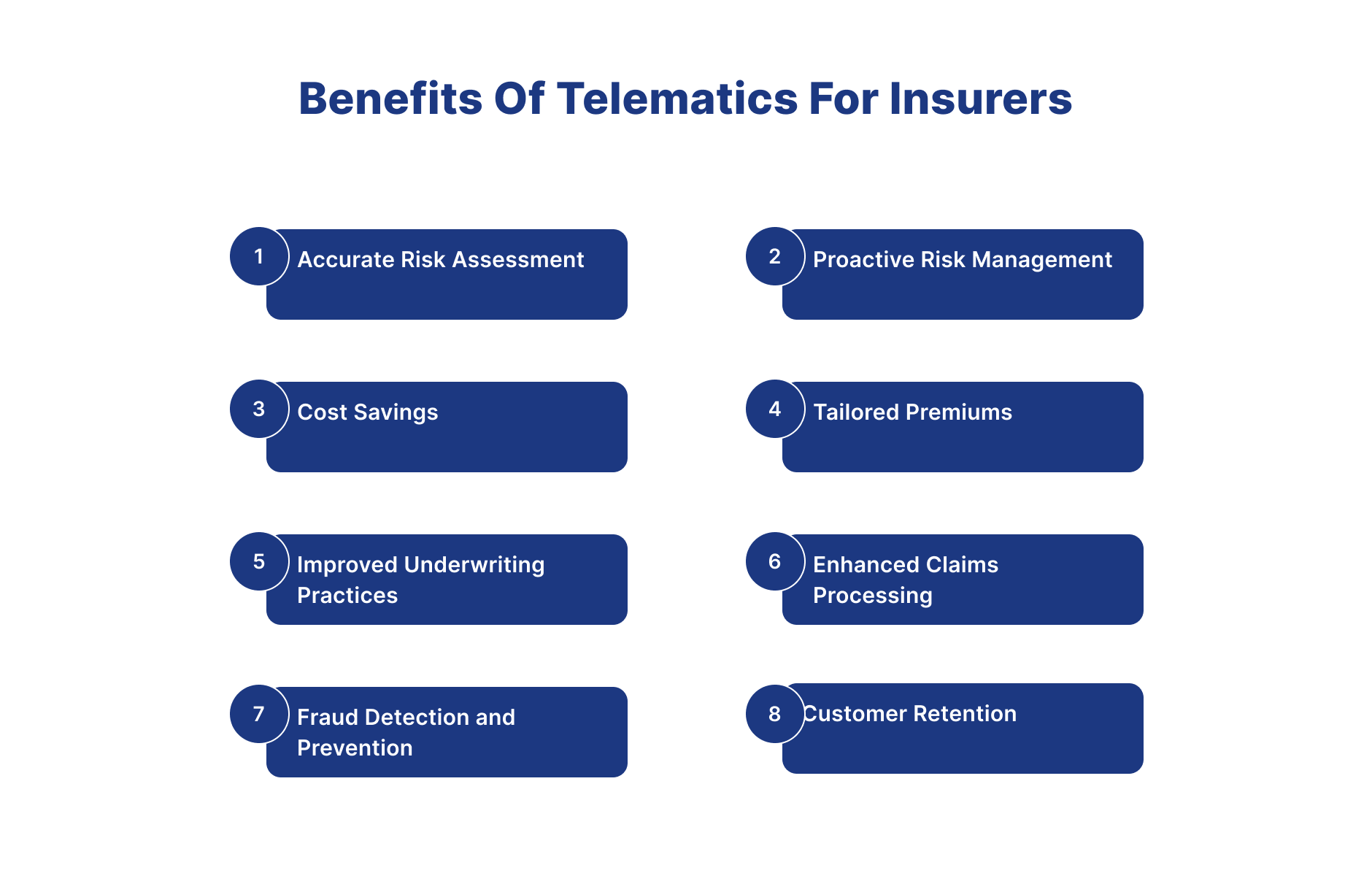

Benefits of Telematics for Insurers

- Before the widespread use of blockchain in the insurance sector, insurance businesses faced several issues that impeded operational efficiency and inhibited innovation. Some of the main pain areas they experienced were:

1. Accurate Risk Assessment

- This technology provides insurers with precise insights on policyholders' driving behaviour in real time. Insurers can evaluate risk with unparalleled accuracy by analysing data points including as speed, acceleration, and braking patterns. This means companies may tailor insurance prices to each individual's risk profile, guaranteeing that the cost of coverage is directly proportional to their actual driving behaviour rather than purely decided by demographic variables.

2. Proactive Risk Management

- It enables insurers to proactively manage risk by recognising high-risk behaviours and responding before an event occurs. By monitoring driver behaviours such as speeding, abrupt braking, and unpredictable driving, insurers may provide coaching and incentives to encourage safer driving. This proactive strategy not only minimises the chance of accidents and claims, but also promotes a safety culture among policyholders.

3. Cost Savings

- Insurance companies may save a lot of money by minimising the number and severity of claims through proactive risk management. Telematics-enabled solutions, such as coaching programmes and real-time feedback, assist to reduce risk and losses connected with accidents. This eventually leads to increased profitability for insurers, which may result in decreased policyholder rates over time.

4. Tailored Premiums

- Telematics enables insurers to customise insurance prices depending on individual driving habits. Policyholders who practise safe driving may be eligible for cheaper premiums, but those who engage in riskier behaviours may face higher rates. This personalised pricing strategy guarantees that premiums appropriately represent the degree of risk offered by each policyholder, leading in more equitable pricing and higher customer satisfaction.

5. Improved Underwriting Practices

- Telematics data gives insurers significant insights into policyholders' driving habits and risk profiles. Using this data, insurers may improve their underwriting methods and make better judgements when evaluating insurance applications. This enables insurers to better match rates with risk and provide more competitive solutions customised to the specific needs of each client.

6. Enhanced Claims Processing

- Telematics data enables quicker claims processing by giving insurers with extensive information about the circumstances around incidents. Real-time data on vehicle speed, impact force, and position allows insurers to speed up claims processing and precisely determine culpability. This decreases claims processing time and enhances the entire customer experience by ensuring that claims are resolved quickly and efficiently.

7. Fraud Detection and Prevention

- This technology helps insurers detect and prevent insurance fraud. By analysing driving data and comparing it to claim details, insurers can detect suspicious trends or anomalies that could suggest fraudulent conduct. This proactive approach to fraud detection assists insurers in minimising losses and maintaining the integrity of their insurance products, eventually benefiting both insurers and policyholders by reducing false claims and keeping premiums low.

8. Customer Retention

- Telematics can help insurers and policyholders build deeper ties, hence improving client retention. By providing personalised pricing based on driving behaviour, insurers may demonstrate their commitment to fairness and transparency, therefore increasing policyholder confidence and loyalty. Furthermore, continuous feedback and assistance offered by telematics programmes may help improve the link between insurers and policyholders, lowering the chance of churn and enhancing client lifetime value.

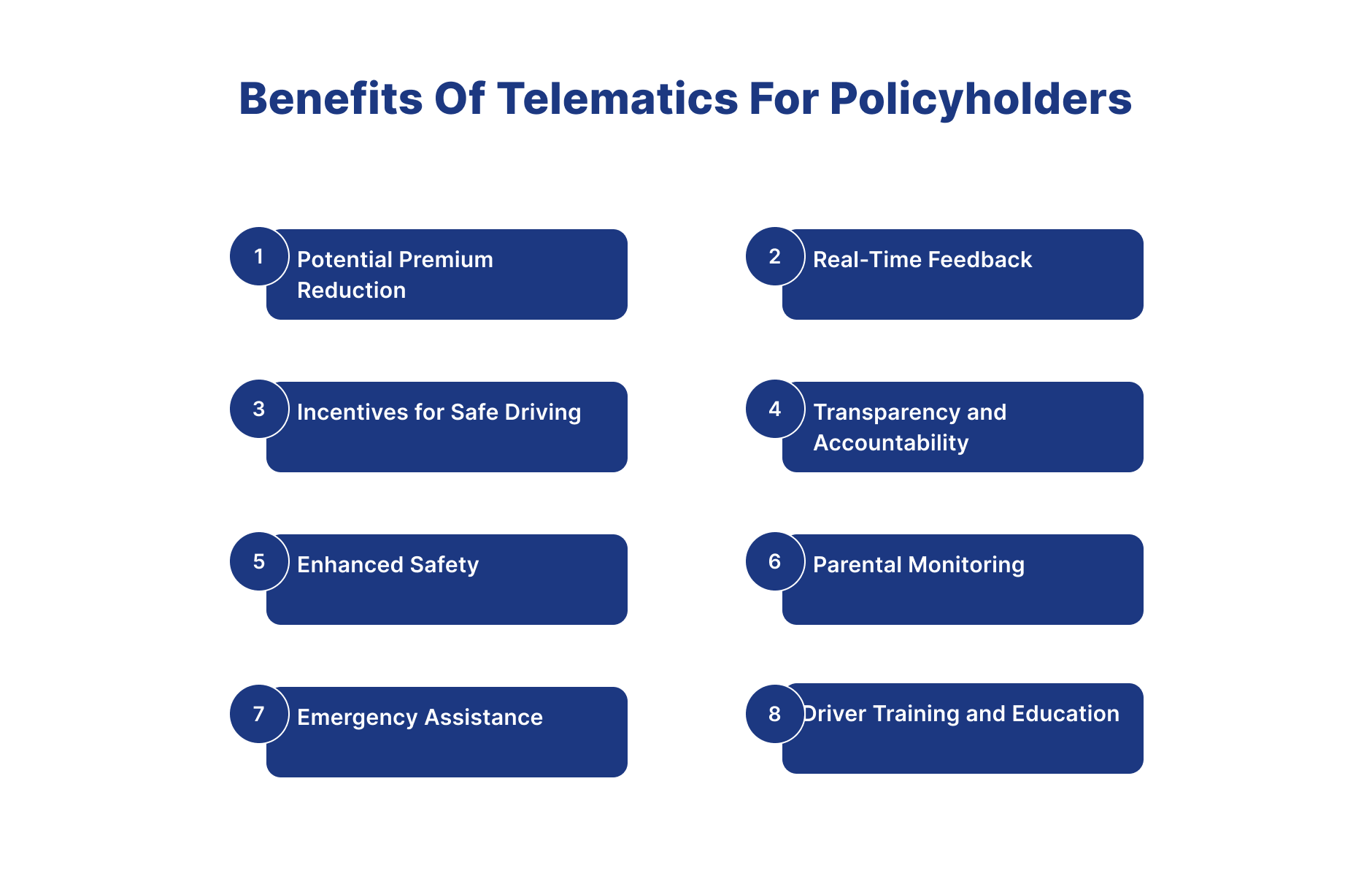

Benefits of Telematics for Policyholders:

- Now that blockchain technology has arrived, insurance businesses are on the verge of overcoming these challenges and opening up new opportunities for growth and creativity. Let's look at how adopting blockchain is transforming the insurance landscape:

1. Potential Premium Reduction

- Policyholders who show safe driving behaviours using telematics data may be eligible for decreased insurance prices. This encourages policyholders to practice safer driving behaviours and rewards responsible behaviour behind the wheel, potentially saving money over time.

2. Real-Time Feedback

- Telematics devices give real-time input on driving performance, allowing policyholders to monitor and improve their driving habits. This feedback loop enables policyholders to make educated judgements regarding their driving patterns and take proactive actions to improve their safety and lower their chances of an accident.

3. Incentives for Safe Driving

- Many insurers provide incentives and awards for safe driving behaviours identified by telematics data. These incentives may include discounts, bonuses, or cashback benefits for long-term safe driving behaviours. By rewarding safe driving, insurers encourage policyholders to prioritise safety and contribute to overall road safety initiatives.

4. Transparency and Accountability

- This technology improves openness and accountability in the insurance process by giving consumers insight into their driving habits and the variables that influence their insurance prices. This transparency fosters confidence between insurers and policyholders, ensuring that insurance pricing is fair and reasonable based on individual risk profiles.

5. Enhanced Safety

- Telematics promotes safe driving behaviours, which adds to improved road safety for policyholders and other drivers. Policyholders who get real-time feedback and incentives for safe driving are more likely to adopt safer driving behaviours, resulting in fewer traffic accidents, injuries, and fatalities. This helps policyholders, their communities, and society as a whole.

6. Parental Monitoring

- Telematics technology can provide parents piece of mind by allowing them to monitor their adolescent children's driving behaviour. Parents may set up alerts and notifications to get information about their child's driving behaviours, such as speeding or forceful braking. This feature encourages young drivers to drive safely and assists parents in instilling responsible behaviours in their children at a young age.

7. Emergency Assistance

- Some telematics systems have emergency assistance elements that will automatically inform emergency services in the case of an accident. This fast reaction capacity has the potential to save lives in emergency circumstances requiring immediate medical intervention. Policyholders benefit from increased safety and peace of mind knowing that aid will arrive quickly in the case of an emergency.

8. Driver Training and Education

- Telematics programmes frequently incorporate driver training and education modules that aim to assist policyholders improve their driving abilities and knowledge. These materials might include interactive lectures, tests, and tailored coaching based on individual driving habits. By investing in driver training and instruction, insurers help policyholders become safer and more responsible drivers, lowering the likelihood of accidents and claims over time.

Conclusion

- In summary, telematics stands out as a spectacular invention in the insurance industry, providing several benefits to both insurers and policyholders. it allows insurers to do exact risk assessments, proactive risk mitigation, and considerable cost savings by reducing the frequency and severity of claims. Furthermore, it provides opportunity to improve client retention, gain competitive advantages, and assert market leadership. it offers policyholders the option of lower premiums, timely feedback on driving behaviours, and incentives for developing safer driving practices. This technology improves transparency, accountability, and road safety, resulting in a more equitable and sustainable insurance environment. As technology advances, it has the ability to completely transform the insurance environment for the better.

About Us

We are a trusted, quality driven and value-driven digital product development company delivering services in BFSI sector.

Digiqt Technolabs is a passion turned into a company. We are a trusted product development company that specializes in turning your ideas into digital solutions utilizing our years of experience in industry-leading technologies.

We deliver high-tech innovations and great solutions for our clients in the most efficient manner regardless of the project complexity.

We are trusted, quality-driven and value-driven product development company.

Our key clients

Companies we are associated with

Our Offices

Ahmedabad

K P Epitome, Block B, Office No: 714, Near DAV International School, Makarba, Ahmedabad-380051, Gujarat.

+91 99747 29554

Mumbai

WeWork, Enam Sambhav C-20, G Block,Bandra- Kurla Complex, MUMBAI-400051, Maharashtra.

+91 99747 29554

Stockholm

Bäverbäcksgränd 10 12462 Bandhagen, Stockholm, Sweden.

+46 72789 9039