Telematics Trends: What's Next for Insurance Industry Disruption?

Posted by Hitul Mistry

/22 Feb 24

Tagged under: #telematics,#trends,#insurance

Introduction

- Incorporating telematics trends is causing a rapid revolution in the insurance industry. Telematics, or the collection and analysis of vehicle data, has transformed how insurers assess risk, set premiums, and communicate with policyholders. As we look ahead, several emerging telematics developments are poised to disrupt the insurance industry further. This blog article will examine these new trends and consider their possible impact on the insurance industry.

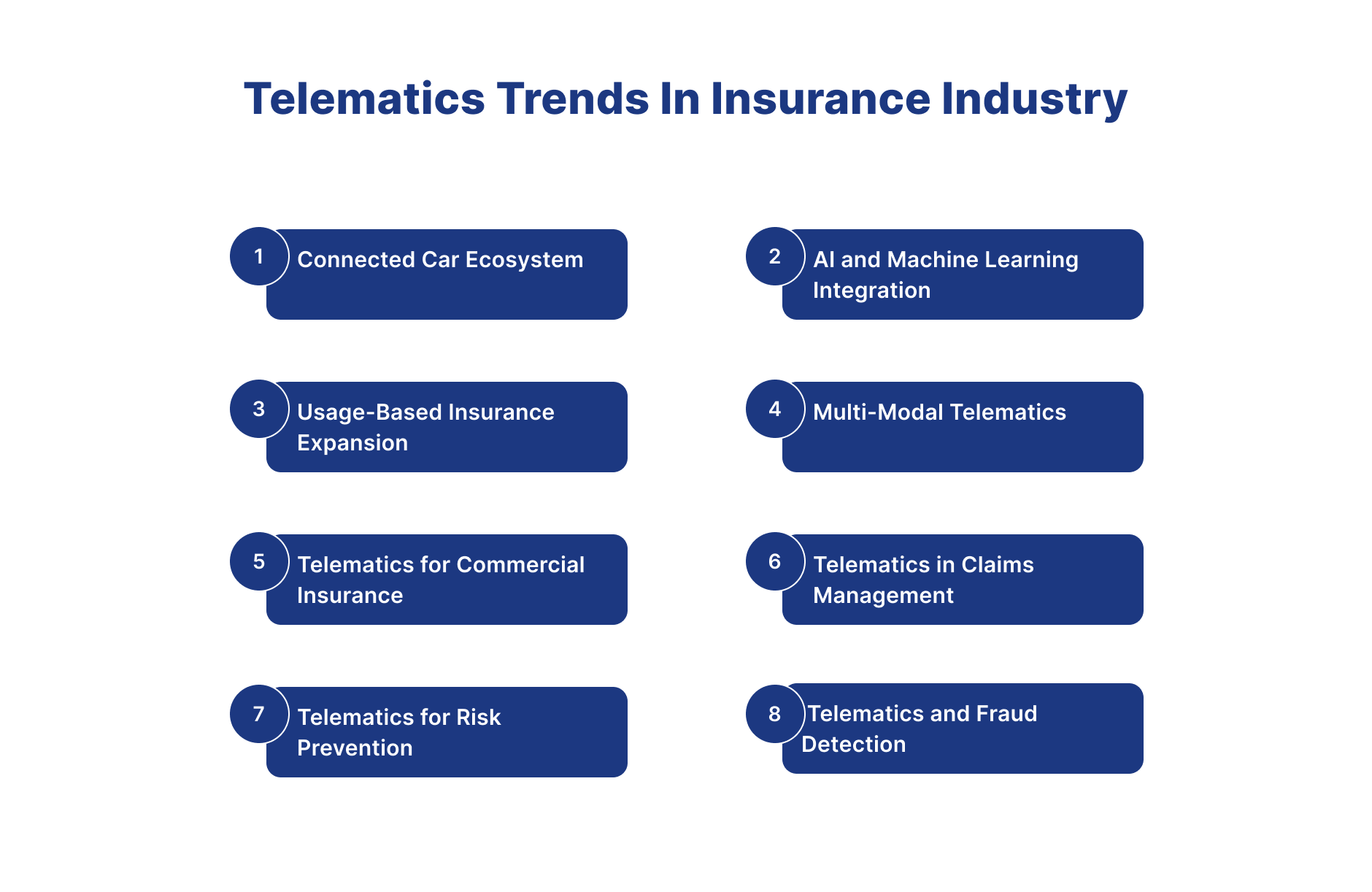

Telematics Trends in Insurance industry

Connected Car Ecosystem

- Traditional insurance pricing models frequently use demographic data to measure risk, which leads to wide generalizations. However, telematics enables insurers to collect real-time data on individual driving behavior, allowing for a more exact risk assessment. By analyzing parameters such as speed, acceleration, braking habits, and distance, insurers may adapt rates to match an individual's actual risk, resulting in more equitable pricing.

AI and Machine Learning Integration

- Another major trend in telematics is integrating artificial intelligence (AI) and machine learning algorithms. Insurers use these technologies to analyze massive volumes of telemetry data and derive relevant insights. Insurers may use AI-powered systems to spot trends, anticipate risk factors, and personalize insurance products based on individual driving behavior. By leveraging AI, insurers may improve their underwriting processes, increase consumer interaction, and optimize claims administration. In this way, telematics trends help the insurance industry.

Usage-Based Insurance Expansion

-

Telematics technology has helped to boost the adoption of usage-based insurance (UBI). UBI plans, which base rates on real driving behavior, provide a more personal and equitable pricing approach than standard insurance. As the use of telematics grows, we anticipate seeing more UBI solutions in various insurance markets, such as auto, home, and business. This trend will allow consumers to regulate insurance premiums and encourage better-driving behaviors. In this way telematics trends help insurance industry.

-

State Farm has a UBI program, Drive Safe & Save, which uses telematics technology to monitor policyholders' driving behavior. State Farm can appropriately adapt insurance prices to individual driving patterns by measuring variables such as miles, speed, braking, and time of day. The Drive Safe & Save program allows clients to cut their insurance premiums by exhibiting better driving habits, promoting responsible driving practices, and lowering the likelihood of an accident.

Multi-Modal Telematics

-

As telematics technology advances and spreads, it is increasingly used in transportation other than vehicles. Nowadays, telematics systems are built into motorcycles, scooters, and even boats. This development into multi-modal telematics gives insurers a fuller view of a policyholder's risk behavior, allowing them to tailor coverage and pricing more precisely. This transition is especially significant in congested metropolitan locations, where traditional vehicle insurance coverage may not fully reflect the wide range of mobility choices available. In this way telematics trends help insurance industry.

-

Companies like GoAbout have developed platforms that integrate various modes of transportation into a single application, including bicycles, public transit, scooters, and even taxis. Users can plan routes, book rides, and pay for services seamlessly across different modes of transport. Telematics data collected from these interactions provides valuable insights into individual mobility patterns and aids city planners in optimizing transportation infrastructure and policies. This approach is particularly beneficial in urban areas where diverse transportation options are prevalent, promoting sustainable and convenient mobility solutions tailored to individual needs while enabling insurers to offer more precise coverage based on comprehensive risk behavior analysis.

Telematics for Commercial Insurance

-

Telematics is also gaining popularity in the commercial insurance market. Fleet managers use telemetry technology to track vehicle performance, monitor driver behavior, and optimize routes. Insurers may use this information to provide more personalized and cost-effective commercial insurance solutions that suit fleet owners and operators' unique demands and risks. This development also allows insurers to work with telematics providers and fleet management businesses. In this way telematics trends help insurance industry.

-

Companies such as "FleetSense" use telematics technology to monitor their vehicle fleets in real-time. FleetSense uses GPS tracking and sensor data to ensure effective route planning and vehicle performance and monitor driver behavior, such as speeding or hard braking. This information is then shared with insurers such as "InsureFleet," which provides customized insurance packages based on real driving behavior and vehicle usage trends. This agreement enables InsureFleet to provide more affordable prices and customized coverage choices, eventually helping fleet owners and operators by encouraging safer driving and lowering insurance costs.

Telematics in Claims Management

-

Telematics is also affecting how insurance handles claims. Telematics data may be used to recreate accident scenes and establish culpability, allowing insurers to speed up claims processing and increase accuracy. Telematics can also help with remote damage assessment, minimizing the need for in-person inspections and speeding up the repair process. Insurers may improve operational efficiency and client experiences by using telematics technology in claims management. In this way, telematics trends help the insurance industry.

-

Allstate uses telematics devices to track its clients' driving patterns and offers personalized insurance premiums. Additionally, Allstate uses telematics data to speed up claims processing by properly recreating accident scenes and analyzing damages remotely. By incorporating telematics technology into claims management, Allstate improves operational efficiency, decreases fraudulent claims, and increases customer happiness.

Telematics for Risk Prevention

-

Moreover, telematics, beyond its typical role in analyzing and managing risks, offers a proactive channel for risk prevention. Insurers aggressively promote safer driving practices among policyholders by providing rapid feedback on driving behaviors and tailoring coaching activities, lowering the likelihood of accidents. Such measures promote a safety culture and offer advantages to insurers by reducing claim occurrences and their cost effect. Finally, this comprehensive strategy saves lives on the road and improves insurers' cost efficiency while increasing customer happiness and loyalty. In this way telematics trends help insurance industry.

-

Geotab's telematics devices collect information on vehicle performance, driver behavior, and route efficiency. Fleet managers use this data to identify unsafe driving behaviors such as forceful acceleration, quick braking, and speeding. Fleet managers can improve road safety by giving drivers real-time feedback and instruction. This technique enhances driver and vehicle safety and lowers insurance costs for fleet operators, saving money and improving operational efficiency.

Telematics and Fraud Detection

-

Telematics technology can help to detect and prevent insurance fraud. Driving data analysis can help insurers uncover unusual trends or behaviors that may imply fraudulent claims. This enables insurers to decrease risk, reduce bogus claims and ensure the integrity of their insurance. portfolios. Telematics can also give supplementary evidence in the event of contested claims, which improves the claims adjudication process. In this way, telematics trends help the insurance industry.

-

State Farm provides the Drive Safe & Save program, which gathers driving information via a mobile app or an OBD-II device fitted in the insured car. State Farm may use telematics data to identify abnormal driving patterns or behaviors that may indicate fraudulent claims, allowing it to reduce risks and improve the integrity of its insurance operations.

Conclusion

- In conclusion, telematics trends are causing considerable change in the insurance business. Emerging telematics trends, such as the expansion of the connected automobile ecosystem, the integration of AI and machine learning, and the growth of usage-based insurance, are redefining how insurers assess risk, set rates, and engage with policyholders. Telematics trends are expanding beyond typical automobiles to encompass multimodal transportation, business insurance, claims administration, risk avoidance, and fraud detection. These innovations not only provide insurers with valuable insights and data for more accurate risk assessment and pricing, but they also open up prospects for increased personalization, cost savings, and better client expert

About Us

We are a trusted, quality driven and value-driven digital product development company delivering services in BFSI sector.

Digiqt Technolabs is a passion turned into a company. We are a trusted product development company that specializes in turning your ideas into digital solutions utilizing our years of experience in industry-leading technologies.

We deliver high-tech innovations and great solutions for our clients in the most efficient manner regardless of the project complexity.

We are trusted, quality-driven and value-driven product development company.

Our key clients

Companies we are associated with

Our Offices

Ahmedabad

K P Epitome, Block B, Office No: 714, Near DAV International School, Makarba, Ahmedabad-380051, Gujarat.

+91 99747 29554

Mumbai

WeWork, Enam Sambhav C-20, G Block,Bandra- Kurla Complex, MUMBAI-400051, Maharashtra.

+91 99747 29554

Stockholm

Bäverbäcksgränd 10 12462 Bandhagen, Stockholm, Sweden.

+46 72789 9039