Paytm Payments Bank Limited’s RBI Ban: Can Tech Restore Trust?

How Paytm Can Rebuild Trust: Beyond Technology: 1.Transparency & Open Communication, 2.Independent Audits and Monitoring, 3.Proactive Collaboration with Regulators.

Introduction

- In the wake of the Reserve Bank of India's (RBI) recent imposition of a ban on Paytm Payments Bank limited, a seismic wave has rippled through the financial sector, casting a spotlight on the indispensable interplay of compliance and trust. As Paytm Payments Bank Limited assures its users of uninterrupted services, the complexities underlying the ban demand a meticulous examination of its future trajectory.

- This blog is poised to unravel the ban's intricacies, explore the details deeply, elucidate how Paytm Payments Bank Limited can leverage technology to surmount compliance challenges and propose strategic initiatives to rebuild trust with regulators and customers. Join us on a journey to understand the depths of Paytm's compliance dilemma and explore the transformative role that technology can play in steering it towards a more secure and trustworthy future.

Understanding the Ban and Its Repercussions

Beyond the Headlines

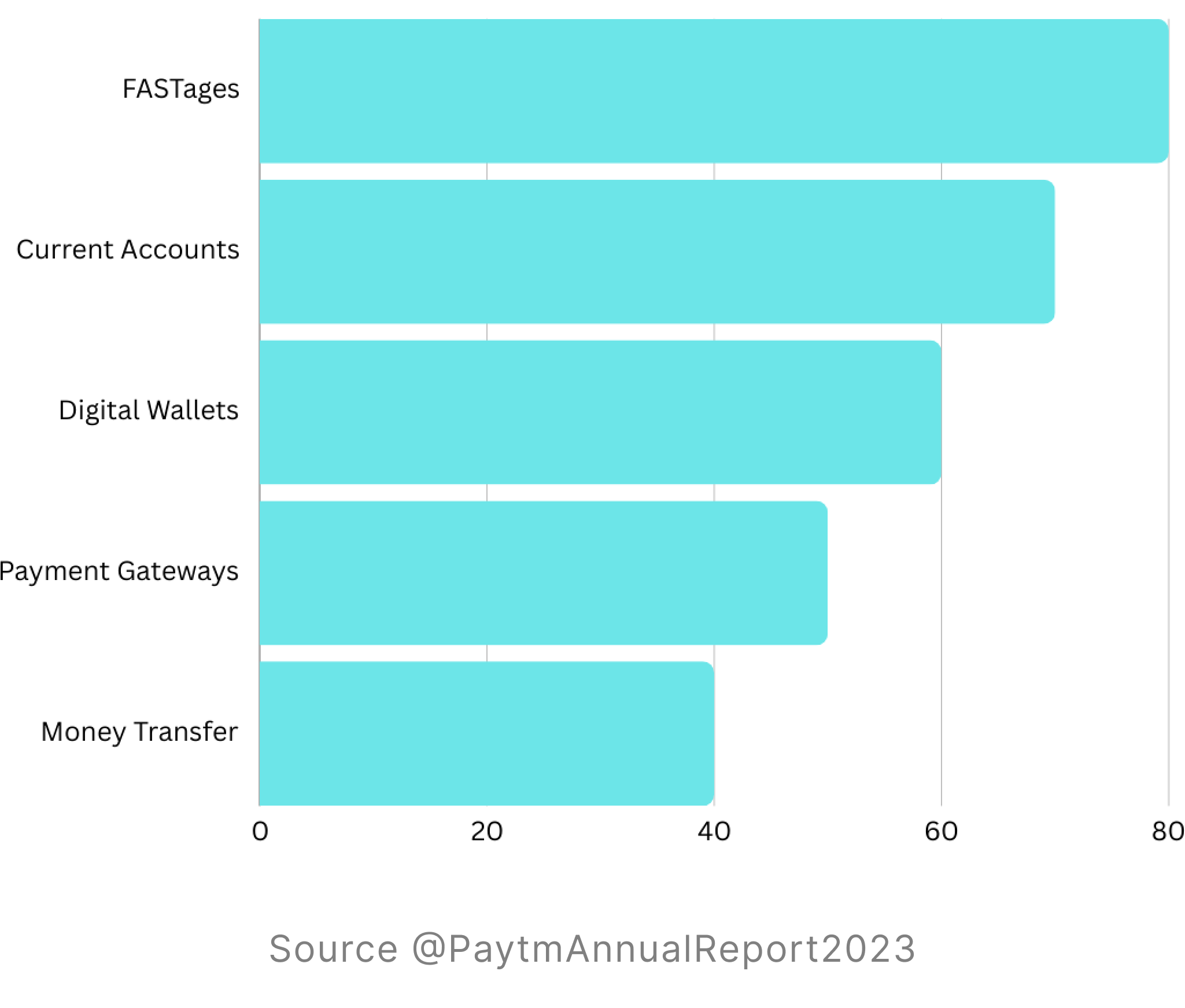

- The RBI's action seems to go beyond merely stopping new deposits. This ban is eventually restricting Paytm Payments Bank Limited from offering its core services like FASTags, and current accounts, potentially impacting millions of users and crippling its core business model.

- The chart illustrates the hypothetical impact levels of the RBI's ban on various Paytm services. It shows the relative effect on services like FASTags, Current Accounts, and others, highlighting how the ban affects Paytm's business model.

Root Causes of Non-Compliance

-

Although official reasons remain undisclosed, sources point to several critical factors

-

KYC Concerns: Inadequate customer verification processes and potential lapses in meeting Know Your Customer (KYC) norms.

-

IT Infrastructure Issues: Weaknesses in IT systems and cyber security raise concerns about data breaches and vulnerabilities.

-

Lack of Information Barriers: Insufficient measures to maintain a clear separation between Paytm Payments Bank and its parent company, One97 Communications, potentially leading to conflicts of interest and regulatory violations.

-

Data Governance Gaps: Questions regarding data handling practices and potential unauthorized access, raising concerns about customer privacy and regulatory compliance.

Paytm Payments Bank Limited Can Leverage Technology for Sustainable Compliance:

1. AI-Powered KYC Automation

Customer Verification Enhancement

- Implementing AI-driven solutions can revolutionize the KYC process. By employing facial recognition, document verification, and biometric authentication, Paytm will be able to enhance the accuracy and efficiency of customer identity verification. This will further ensure compliance with KYC norms and expedite the onboarding process for new users.

Continuous Monitoring and Updating

- AI algorithms can enable continuous monitoring of user activities, identifying patterns and anomalies that may indicate suspicious behavior. Regularly updating customer information and performing dynamic risk assessments can help Paytm stay ahead of evolving compliance requirements and minimize the risk of fraudulent activities.

2. Enhanced Data Security & Governance

Robust Encryption Mechanisms

- Implementing state-of-the-art encryption protocols ensures that sensitive customer data is securely transmitted and stored. Advanced encryption algorithms and secure key management practices create a formidable barrier against unauthorized access, addressing concerns regulators and users raise.

Access Control and User Permissions

- Establishing stringent access control mechanisms ensures that only authorized personnel can access sensitive data. Implementing a principle of least privilege, where employees have access only to the data necessary for their roles, can minimize the risk of internal data breaches.

Regular Security Audits

- Regular security audits, including penetration testing and vulnerability assessments, are essential. These audits can identify potential weaknesses in Paytm's IT infrastructure, allowing for prompt remediation and demonstrating a proactive commitment to data security.

Data Governance Frameworks

- Implementation of the comprehensive framework involves defining policies and procedures for data handling, storage, and sharing. This ensures compliance with regulatory requirements and establishes a culture of responsible data management within the organization.

3. Exploring Blockchain for Transparency and Trust

Transparent Transactions

- Integrating blockchain technology into specific aspects of Paytm's ecosystem can enhance transaction transparency. The decentralized and immutable nature of blockchain ensures that transaction records are secure, transparent, and tamper-proof, fostering trust among users and regulators.

Improved Auditability

- Blockchain's distributed ledger technology provides a transparent and traceable record of transactions. This facilitates efficient auditing processes and allows regulators to independently verify the integrity of Paytm's financial transactions.

Streamlined Regulatory Oversight

- Implementing blockchain can streamline regulatory oversight by providing regulators with real-time access to transaction data. This can contribute to a more collaborative relationship with regulatory bodies, addressing concerns and ensuring compliance in a timely manner.

How Paytm Payments Bank Limited Can Rebuild Trust: Beyond Technology

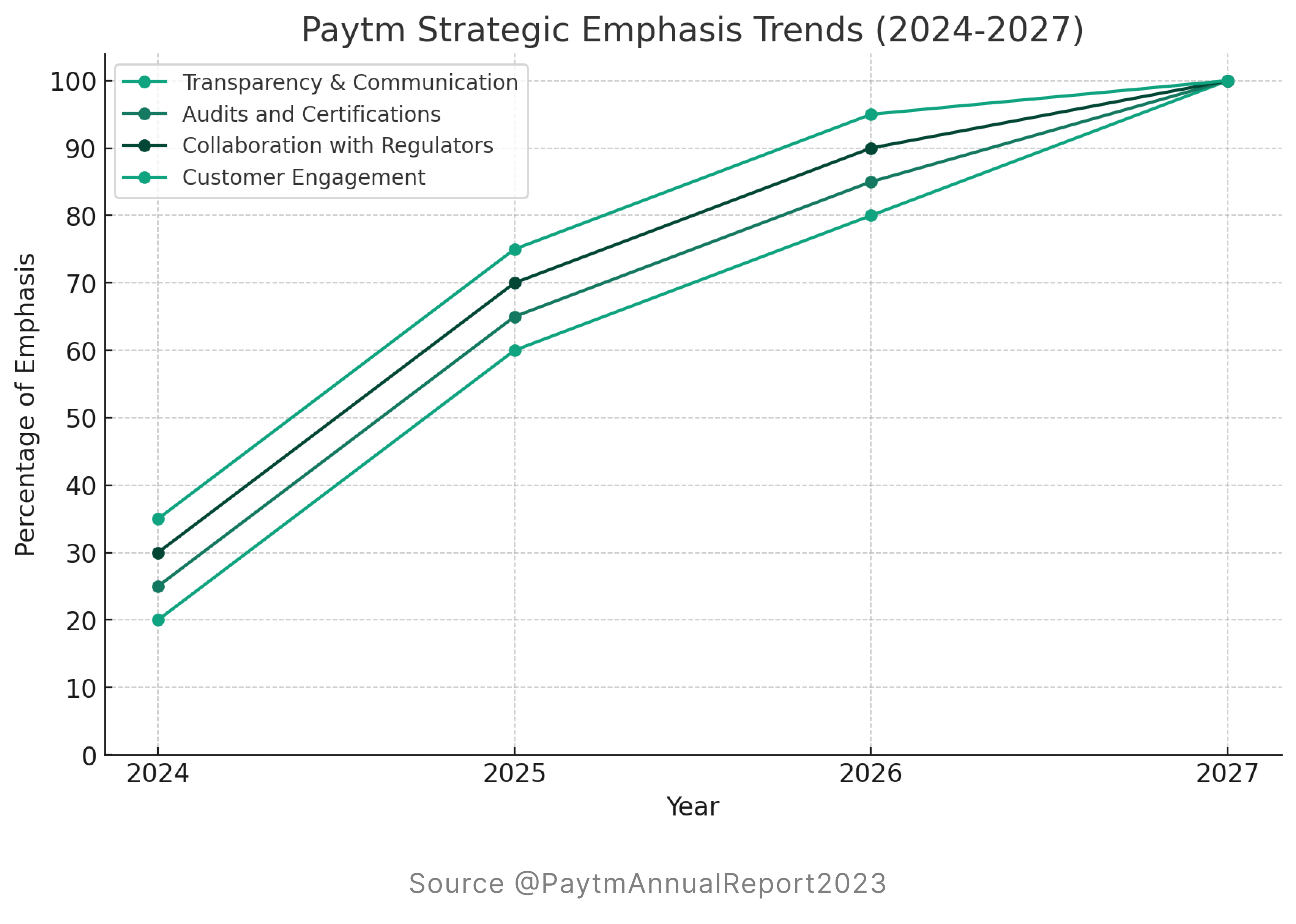

- The data analysis reveals a strategic evolution in Paytm's trust-building approach across four key categories: "Transparency and communication," "Audits and Certifications," "Collaboration with Regulators," and "Customer Engagement." Beginning in 2024, each category shows an upward trend, indicating a deliberate increase in emphasis over time. While there is a slightly higher initial focus on "Customer Engagement" and "Collaboration with Regulators," the trajectory demonstrates a convergence, with all categories approaching nearly equal emphasis by 2027. This suggests a holistic and comprehensive strategy employed by Paytm in rebuilding trust, showcasing a commitment to balanced growth across these critical trust-building pillars.

1. Transparency & Open Communication

Clear Communication Strategy

- Paytm Payments Bank Limited should consider establishing a clear and comprehensive communication strategy to keep users, regulators, and stakeholders informed about its compliance efforts. Regular updates through official statements, press releases, and transparent disclosures can provide insights into the measures being taken to address compliance issues.

Acknowledgment of Challenges

- Openly acknowledging the challenges and shortcomings that led to the regulatory actions is crucial. Paytm Payments Bank Limited can demonstrate a commitment to rectifying issues and building a stronger, more compliant platform by taking responsibility for any lapses.

Educational Initiatives

- Educational campaigns aimed at users can help demystify compliance processes. Providing information on KYC requirements, data protection measures, and other regulatory aspects can empower users, fostering a sense of trust and understanding.

2. Independent Audits and Monitoring

Reputed Audit Firms

- Engaging reputable audit firms to assess Paytm's compliance practices independently adds a layer of credibility. Third-party audits provide an unbiased evaluation, offering assurance to regulators and users alike.

Automated Compliance Alerts and Monitoring

- Automated Compliance Alerts and Monitoring, facilitated by innovative RegTech tools, empower banks to track and adapt to regulatory changes efficiently. These solutions provide real-time alerts, enabling proactive responses to emerging compliance requirements and potential risks.

3. Proactive Collaboration with Regulators

Open Channels of Communication

- Establishing open and continuous communication channels with regulators, especially the RBI, is essential. Proactively sharing information, seeking feedback, and addressing concerns in real time can build a collaborative relationship beyond mere compliance.

Regulatory Workshops and Training

- Conducting workshops and training sessions with regulatory authorities can foster mutual understanding. This proactive approach allows Paytm Payments Bank Limited to stay abreast of evolving regulatory expectations while showcasing a commitment to compliance.

Collaborative Solutions

- Actively seeking input from regulators in developing compliance solutions can be beneficial. This collaborative approach ensures that Paytm's practices align with regulatory expectations, minimizing the risk of future non-compliance.

4. Proactive Customer Engagement

Customer Support and Feedback

- Strengthening customer support services to address queries and concerns promptly is crucial. Paytm Payments Bank Limited should actively seek and incorporate user feedback to demonstrate a customer-centric approach, fostering a sense of trust and reliability.

Enhanced User Education

- Investing in user education programs can help customers understand the steps Paytm Payments Bank Limited is taking to enhance compliance. This can include tutorials, FAQs, and informative content that empowers users to make informed decisions about their financial transactions.

Conclusion

-

The conclusion highlights Paytm's critical situation following the RBI ban, emphasizing the need for compliance and trust in the financial sector.

-

The conclusion stresses the importance of rebuilding trust through open communication, independent audits, monitoring, and proactive regulatory engagement. Customer-centric initiatives, like user education, are also deemed crucial for restoring confidence. The blog underscores the need for Paytm Payments Bank Limited to comply with regulations and set new standards in responsible fintech practices, considering the broader economic and political context. This approach could help Paytm Payments Bank Limited not only navigate its current challenges but also emerge as a leader in the Indian fintech industry., and proactive regulatory engagement.

-

Customer-centric initiatives, like user education and loyalty programs, are also deemed crucial for restoring confidence. The blog underscores the need for Paytm Payments Bank Limited to comply with regulations and set new standards in responsible fintech practices, considering the broader economic and political context. This approach could help Paytm Payments Bank Limited not only navigate its current challenges but also emerge as a leader in the Indian fintech industry.

DISCLAIMER

- The content stated in this blog is analyzed as per the data available and personal views of the author and hence, does not reflect the Company’s opinion. The graphical representations and data collected in the given blog is based on the research of the author. The company do not affirm the entire accuracy of the data collected. This blog disclaims any and all the views / opinions that the readers may infer post reading this blog; reader’s discretion is advised.

Contact Us

Frequently Asked Questions

What are Paytm Payments Bank Limited’s RBI Ban?

Paytm Payments Bank Limited’s RBI Ban are AI-powered systems that automate and optimize processes using machine learning, natural language processing, and intelligent decision-making capabilities.

How do Paytm Payments Bank Limited’s RBI Ban work?

Paytm Payments Bank Limited’s RBI Ban work by analyzing data, learning patterns, and executing tasks autonomously while integrating with existing systems to streamline operations and improve efficiency.

What are the benefits of using Paytm Payments Bank Limited’s RBI Ban?

The benefits include increased efficiency, reduced operational costs, improved accuracy, 24/7 availability, better customer experience, and data-driven insights for decision-making.