Deepfakes in Fintech Industry:-8 Ways How it Can Be a Rising Threat

Posted by Hitul Mistry

/20 Nov 23

Tagged under: #deepfakes,#deepfakeaiinfintech,#fintech

DeepFakes in fintech industry pose a significant threat, potentially leading to significant fraud and opening new opportunities for scammers

Introduction

- Deepfakes is a technology that can manipulate audio, video, and imagery and make them look real. For example, the Fraudster can replace a person's face in any video. It has emerged as an alarming issue in various industries. The FinTech sector is also a sector that can be affected by DeepFakes; their implications are substantial. deepfakes in fintech industry can make a huge impact, and they also open many doors to create fraud for the scammers.

- It has become much easier to create DeepFake videos. Services such as

deepfakesweb.com

microsoft deepfake

hoodem.com

-

and many more are available to develop this type of fake videos.

-

Many celebrities worldwide have found their DeepFakes created and damaged their reputation. Indian Prime Minister Mr. Narendra Modi also experienced his fake video, which was created using this technology and went viral on Social Media, saying it is a real threat.

-

Here are 8 ways deepfakes in fintech industry can make an impact.

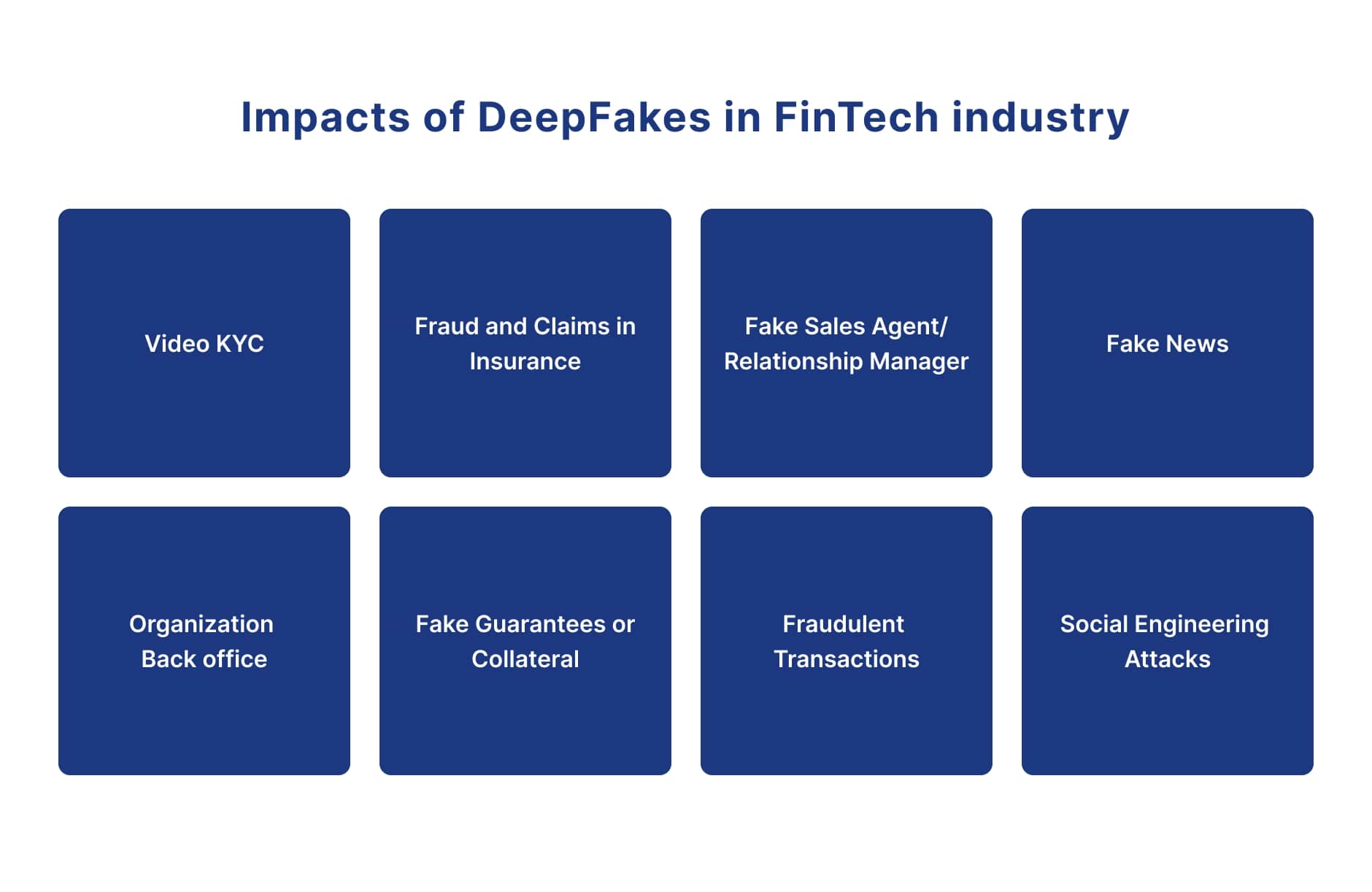

Impacts of DeepFakes in FinTech industry

1.Video KYC

- Regulators have allowed digital Video KYC in FinTech. Fraudsters can create a DeepFake video of buyers. It can lead to Fraudulent Identities, Erose trust in Video KYC, Money Laundering, Identity Theft, and Regulatory penalties.

2.Fraud and Claims in Insurance

-

Deepfakes could enable individuals to fabricate convincing evidence supporting insurance claims, such as doctored videos or images of accidents, injuries, or property damage.

-

Consequently, deepfakes in fintech industry could lead to increased fraudulent claims, resulting in financial losses for insurance companies. Fraudsters can also create DeepFakes for vehicles with fake accidents, fake fires in place, counterfeit assessments of crops, etc.

-

Fraudsters can create videos or images with DeepFake to falsify witness statements expert testimonies, or even alter documentation related to insurance claims. Consequently, this can mislead investigations, affect liability determinations, and impact settlements.

3.Fake Sales Agent/Relationship Manager

- FinTech sales are still majorly assisted. Agents on the field get in touch with the customers and serve them. Fraudsters can generate fake audio of agents and RMs and talk to customers as real customers. With innovation in GenerativeAI and multi-language Speech Models, real-looking conversations can happen, and customers can become victims of fraud. Fraudsters can also distribute DeepFake Audio over WhatsApp.

4.Fake News

- Fraudsters can create DeepFake videos of influencers/celebrities/CXO and spread fake news. Such fake news can manipulate markets, spread misinformation about the company/country/economy, and fail algorithm trading if it relies on market sentiment and cyber fraud.

5.Organisation Backoffice

- Fraudsters can become fake employees of the organization, engaging in conversations with customers while posing as legitimate staff members. They may undertake activities that could significantly impact the organization's reputation, leveraging this technology.

6.Fake Guarantees or Collateral

- Fraudsters can create fake collateral documentation or videos, misleading lenders into approving loans based on misrepresented or non-existent assets. Fraudsters can also use deepfakes in fintech industry to fabricate or manipulate evidence supporting loan applications, such as faked income verification videos or altered financial documents, leading to increased fraudulent loans.

7.Fraudulent Transactions

- Deepfakes could facilitate fraudulent transactions by creating realistic but fake authorization or verification video images, leading to unauthorized access to funds or services.

8.Social Engineering Attacks

- Deepfakes can be part of social engineering scams, where fraudsters can manipulate audio or video content to deceive individuals into revealing sensitive financial information or authorizing fraudulent transactions.

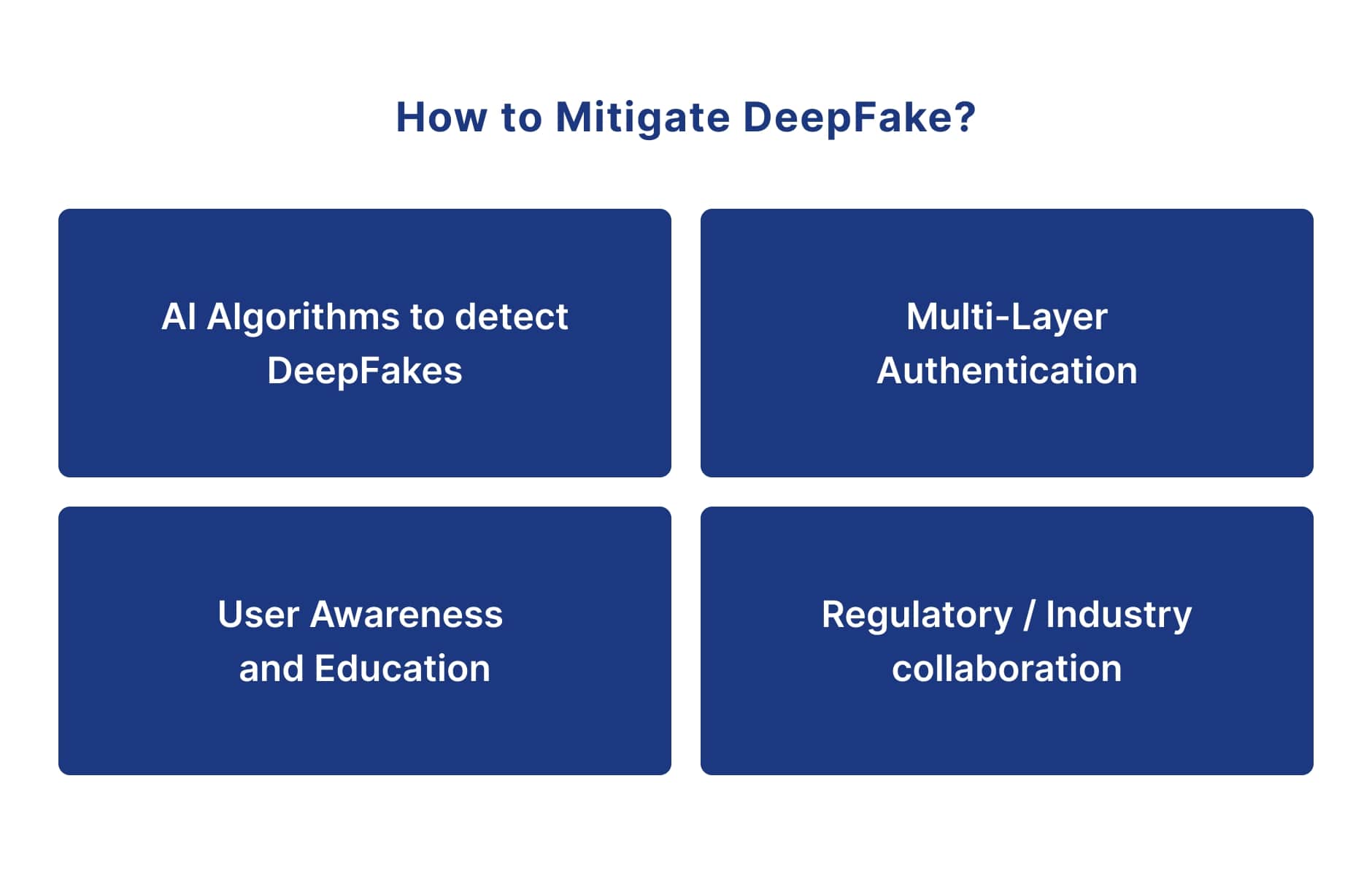

How to Mitigate DeepFake?

1.AI Algorithms to detect DeepFakes

-

AI Models such as XceptionNet, MesoNet, Capsule Network, etc, were developed to detect deepfakes. Organizations can leverage such technologies to detect fraud early on.

-

AI Implementation Audits of organizations can also be done regularly to find leaks in processes and workings. At Digiqt Technolabs, we do such audits and suggest and implement AI solutions to grow the organization and fraud detection techniques.

2.Multi-Layer Authentication

- Implementing multi-layered and robust authentication processes, including biometric verification, behavioral analysis, and real-time transaction monitoring, can enhance security and detect anomalies that may indicate deepfake-related fraud.

3.User Awareness and Education

- Educating customers about the risks associated with deepfakes in banking, emphasizing the importance of verifying transaction details, using secure channels, and being vigilant about sharing personal information.

4.Regulatory/Industry Collaboration

- Centralized solutions can be developed with continuous collaboration with the regulatory/industry.

Conclusion

-

DeepFakes in Fintech industry pose a new threat to the sector. However, taking corrective actions early on can save the organization from future losses.

-

In facing the challenges posed by deepfakes in the fintech industry, a united front of technological innovation and robust security measures is essential. As the fintech landscape continues to evolve, proactive stance against deepfakes becomes paramount to ensure the sustained trust of users in digital financial ecosystems. Only by acknowledging, addressing, and mitigating the risks associated with deepfakes can the fintech industry fortify its foundations and pave the way for a secure, resilient, and trustworthy financial future.

-

Deepfakes in FinTech industry, with their disconcerting ability to convincingly replicate authentic interactions, sow seeds of doubt and erode the trust that users once confidently placed in digital financial systems. The magnitude of this existential threat is underscored by the lack of comprehensive safeguards and the inadequacy of detection mechanisms. The future of fintech is at a precarious crossroads, with the deepfake menace standing as an insurmountable obstacle to the credibility and reliability of financial services.

-

At Digiqt Technolabs, we do AI Audits and suggest solutions that can lead to savings in cost, automation, and fraud detection. Get in touch or to talk to our experts.

Contact Us

About Us

We are a trusted, quality driven and value-driven digital product development company delivering services in BFSI sector.

Digiqt Technolabs is a passion turned into a company. We are a trusted product development company that specializes in turning your ideas into digital solutions utilizing our years of experience in industry-leading technologies.

We deliver high-tech innovations and great solutions for our clients in the most efficient manner regardless of the project complexity.

We are trusted, quality-driven and value-driven product development company.

Our key clients

Companies we are associated with

Our Offices

Ahmedabad

K P Epitome, Block B, Office No: 714, Near DAV International School, Makarba, Ahmedabad-380051, Gujarat.

+91 99747 29554

Mumbai

WeWork, Enam Sambhav C-20, G Block,Bandra- Kurla Complex, MUMBAI-400051, Maharashtra.

+91 99747 29554

Stockholm

Bäverbäcksgränd 10 12462 Bandhagen, Stockholm, Sweden.

+46 72789 9039