AI Use Cases In FinTech Industry: 6 Use Cases Of Implementing AI To Improve The FinTech Industry

The FinTech industry has experienced significant changes due to the introduction of AI use cases in FinTech industry

Introduction

- A revolutionary force is at work in the fast-paced world of finance and technology, changing the financial industry from the ground up. Let me introduce Artificial Intelligence (AI), the driving force behind a dramatic change in the FinTech industry. AI is emerging as the engine pushing FinTech into previously unexplored frontiers of efficiency, security, and innovation as the digital heartbeat of finance quickens.

- Join us as we explore the fascinating application cases where AI is transforming and expanding the FinTech sector to unprecedented levels of potential. Greetings from the future, where the fusion of technology and finance is not only a theory but a reality changing how we see and interact with the financial industry. There are some AI use cases in FinTech industry, which are as below.

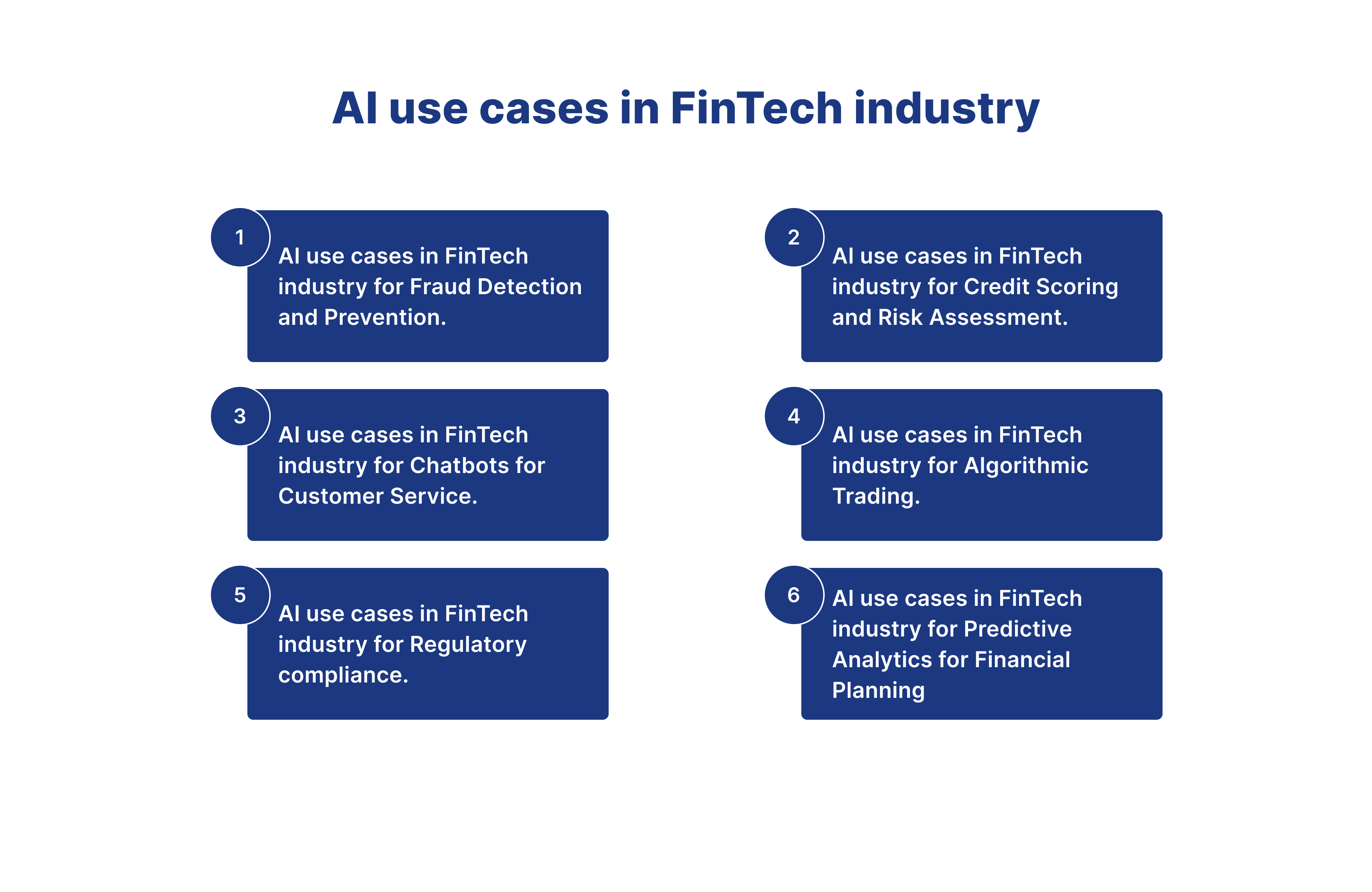

AI use cases in FinTech industry

1. AI use cases in FinTech industry for Fraud Detection and Prevention

-The key to combating financial fraud is now artificial intelligence (AI). Machine learning algorithms may analyze large-scale databases in real-time, which can spot trends and abnormalities that point to fraud. FinTech organizations may strengthen security measures and safeguard customers and businesses from financial dangers by leveraging artificial intelligence (AI). This can be achieved by recognizing anomalous spending patterns or unauthorized account access.

- Paytm uses machine learning to prevent fraud. With the help of machine learning, Paytm will analyze large amounts of data to find patterns and anomalies and identify suspicious activities. By using machine learning, Paytm can save its customers from fraud.

2. AI use cases in FinTech industry for Credit Scoring and Risk Assessment

-

With AI's introduction, traditional credit rating methods are rapidly evolving. To determine creditworthiness more precisely, machine learning algorithms now analyze a broader range of structured and alternative data from multiple sources. This transformation is especially valuable for fintech firms and every cryptocurrency wallet development company, as AI-driven risk assessment enhances fraud detection, strengthens compliance, and builds more secure and reliable digital financial ecosystems. This makes it possible for FinTech lenders to make wise choices, particularly for those with short credit histories. Due to AI's dynamic nature, loan portfolios may be optimized, and default risk can be decreased in real time through monitoring.

-

City banks use AI to check the credit score of the business. City Bank will analyze all the bank statements of the corporate business, and on the basis of that, it will decide whether to approve a loan or not.

-

CITADEL, a Chicago-based company, uses AI for risk assessment in investment. Ai will analyze historical data, which will provide details about how much risk is involved in the investment.

3. AI use cases in FinTech industry for Chatbots for Customer Service

-

Chatbots with AI capabilities are now essential for FinTech client support. These smart devices answer common questions, assist users with transactions, and give prompt answers. Chatbots improve customer service efficiency by using machine learning and natural language processing to provide fast and accurate assistance. This frees up human agents to work on more difficult problems.

-

Bank of America uses Erica Chabot to answer all customer queries in real-time. It can solve queries related to the stolen debit card, check the balance, and temporarily lock or unlock the debit card.

4. AI use cases in FinTech industry for Algorithmic Trading

- AI is using complex algorithmic models to transform the trading industry. Machine learning algorithms examine past data, current information, and market patterns to execute trades precisely. In addition to automating trading procedures, this optimizes investment portfolios and guarantees that financial institutions may Immediately and successfully seize market possibilities.

- TradeStation offers Tradestation AI, an AI-powered trading tool. It analyses market data and produces trading suggestions by utilizing machine learning algorithms. It provides trading suggestions and real-time notifications based on trends in technical analysis and other indicators.

5.AI use cases in FinTech industry for Regulatory compliance

-

AI's advanced computational models are changing the trading scene. Machine learning algorithms employ real-time information, historical data, and market trends analysis to execute trades precisely. Financial institutions may quickly and effectively take advantage of market opportunities, automating trading procedures and optimizing investment portfolios.

-

Some banks use AI to automate consumer tasks, in which customers only need to upload their documents on the bank portal, and after that, AI analyzes all the customer data. Ai also can find some suspicious activities the customer has done in the past

5. AI use cases in FinTech industry for Predictive Analytics for Financial Planning

-

AI makes sophisticated predictive analytics possible for budgeting. Machine learning algorithms can forecast future financial situations by examining past data, market patterns, and economic indicators. This enables people and organizations to decide on savings, investments, and general financial plans with knowledge.

-

Some financial planning agencies use AI to create a financial plan for the customer. AI will use various data like market trends, customer income and expenses, economic indicators, Etc.. with the help of this data; AI will suggest the best financial plan for the customer.

Conclusion

- In conclusion, the application of AI in the FinTech sector offers fascinating chances to boost productivity, improve client experiences, and simplify financial procedures. The FinTech industry has the potential to unleash unprecedented levels of innovation and revolutionize how we transact, invest, and manage our money through the responsible use of AI technology and the resolution of related issues. As we go, improving AI's beneficial effects in the FinTech sector will need striking a careful balance between realizing its promise and ensuring its use is morally and responsibly done.

How Digiqt will help you to adapt AI in your company

-

At Digiqt, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients with monthly updates on the software development progress.

-

Digiqt's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

What are AI Use Cases In FinTech Industry?

AI Use Cases In FinTech Industry are AI-powered systems that automate and optimize processes using machine learning, natural language processing, and intelligent decision-making capabilities.

How do AI Use Cases In FinTech Industry work?

AI Use Cases In FinTech Industry work by analyzing data, learning patterns, and executing tasks autonomously while integrating with existing systems to streamline operations and improve efficiency.

What are the benefits of using AI Use Cases In FinTech Industry?

The benefits include increased efficiency, reduced operational costs, improved accuracy, 24/7 availability, better customer experience, and data-driven insights for decision-making.