AI Solve Problems In FinTech: 6 Problems That Can Be Solved By Implementing AI In The FinTech Industry

Ai and FinTech holds the key to unlocking possibilities and tackling intricate challenges. Ai solve problems in fintech with unparalleled efficiency and security.

Introduction

- Welcome to the era where artificial intelligence (AI) serves as the silver bullet, shattering limits and unveiling innovative solutions to entrenched problems. AI emerges as the game-changer in the dynamic realm of financial technology (FinTech), where innovation is the currency. This formidable technology holds the key to unlocking possibilities and tackling some of the sector's most intricate challenges. Ai solve problems in fintech with unparalleled efficiency and security.

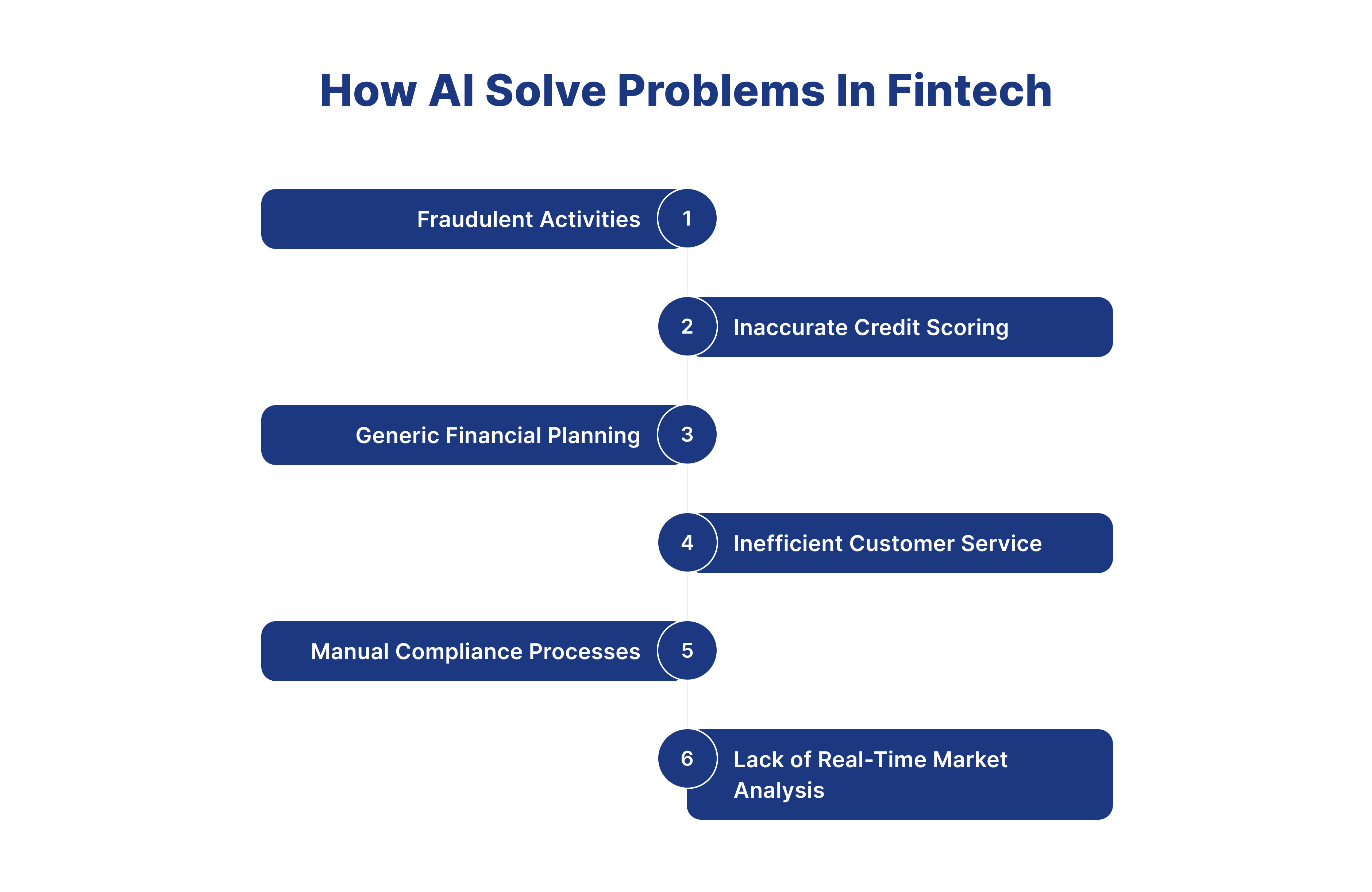

How ai solve problems in fintech

1.Fraudulent Activities

-

In the pre-AI era, fraudsters always used new ways to commit fraud using the latest technology. FinTech companies need to stay updated with the latest technologies and trends in the traditional method to find fraud activities. Traditional fraud detection techniques were frequently reactive, depending on predefined rules and past data. Due to this, it became difficult to recognize sophisticated and new threats, which caused significant financial losses for companies and customers.

-

FinTech organizations can now detect and prevent fraud in real-time thanks to the incorporation of AI. Large-scale databases are analyzed by machine learning algorithms, which then spot minute patterns that point to possible fraud. The transition from reactive to proactive fraud detection has improved client security and significantly decreased financial losses. With the help of this way ai solve problems in fintech.

2.Inaccurate Credit Scoring

-

In conventional credit scoring, FinTech companies use historical data to check the customer's credit score. Because of using historical data and human power, there might be some possibility that humans can analyze wrong data and provide inaccurate credit scoring to the customer. This will lead to the customer being unable to use some Financial products based on credit scoring.

-

Credit scoring has revolutionized thanks to AI algorithms integrating various data sources. A more comprehensive assessment of a person's creditworthiness now considers their behavior on social media, online purchases, and non-traditional credit indicators. This has increased financial inclusion while also raising credit scoring accuracy. With the help of this way, Ai solve problems in fintech.

3.Generic Financial Planning

-

Financial planning in pre-AI era FinTech companies use a one-size-fits-all approach where companies design the same financial planning for all the customers. They do not analyze the customer data. This can lead to customers getting wrong financial planning and their expenses being higher than their income. Customers searched for more specialized solutions in the lack of personalized guidance.

-

AI-powered robo-advisors have brought in a new era of personalized financial planning. AI-driven solutions offer personalized advice by examining users' investing choices, spending patterns, and life objectives. Personalized financial methods replace generic suggestions, improving client satisfaction and guaranteeing aspirational congruence. With the help of this way, ai solve problems in fintech.

4.Inefficient Customer Service

-

In the traditional way of customer service, FinTech companies need to use human power to tackle customer queries. Suppose companies use human power in customer service. In that case, it might lead to human agents not handling multiple queries at a single time, and after some time, they get frustrated with the same queries, and they can give the wrong solution. Because of this, the customer didn't get an accurate answer to their query. In the traditional way, services will be offered for a limited time because these customers might not get the services in real-time.

-

FinTech customer service has transformed with the introduction of AI-driven chatbots. With the ability to interpret natural language, these bots can respond to standard inquiries, offer help instantly, and even help with simple problem-solving. This guarantees availability around the clock and greatly boosts client interaction efficiency. With the help of this way, ai solve problems in fintech.

5.Manual Compliance Processes

-

In the manual compliance process, FinTech companies need to hire a compliance manager who monitors all the transactions and generates reports according to them. Because the company uses human power, there might be some possibility of generating the wrong reports, or humans can forget to monitor some amount of transactions, which is a very time-consuming and costly process.

-

AI has made regulatory compliance procedures more efficient by automating operations related to reporting and monitoring. Large-scale data analysis is possible using machine learning algorithms, guaranteeing that transactions adhere to changing regulatory requirements. This automation improves accuracy and speed in adhering to compliance rules while lowering the risk of regulatory infractions. With the help of this way, ai solve problems in fintech.

6.Lack of Real-Time Market Analysis

- In the pre-AI era, FinTech companies struggled to provide a real-time market analysis to their customer because they would use human power to analyze the market. Human power can not analyze massive amounts of data in real-time.

- The application of AI has transformed algorithmic trading as it offers real-time market analysis. Machine learning algorithms may process massive datasets at astonishing speeds, which can then spot patterns and trends that human analysts would miss. FinTech companies can make more strategic, timely, and informed investment decisions. With the help of this way, ai solve problems in fintech.

Conclusion

- In conclusion, integrating AI into the finance sector has enormous potential to address various issues. AI has the potential to drastically change how we handle and engage with financial services, from improving fraud detection to completely changing the consumer experience. Using machine learning and predictive analytics, the financial sector may overcome obstacles like cybercrime, ineffective operations, and data analysis.AI has the potential to revolutionize the fintech industry by facilitating creative problem-solving, boosting productivity, and eventually creating a safer and more inclusive financial system.

How Digiqt can help you to implement AI in your company to solve complex problems

-

At Digiqt, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients monthly updates on the software development progress.

-

Digiqt's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

What are AI Solve Problems In FinTech?

AI Solve Problems In FinTech are AI-powered systems that automate and optimize processes using machine learning, natural language processing, and intelligent decision-making capabilities.

How do AI Solve Problems In FinTech work?

AI Solve Problems In FinTech work by analyzing data, learning patterns, and executing tasks autonomously while integrating with existing systems to streamline operations and improve efficiency.

What are the benefits of using AI Solve Problems In FinTech?

The benefits include increased efficiency, reduced operational costs, improved accuracy, 24/7 availability, better customer experience, and data-driven insights for decision-making.