AI Solve Problems In The Banking Industry: 6 problems can be solved using AI in the banking sector

The banking sector, a pillar of the global economy, faces a slew of issues. With the implementation of ai in banking industry this problems can be solve.

Introduction

- The banking industry constantly changes due to technological improvements and shifting client expectations. AI brings skills that can address various difficulties in the banking sector while also revolutionizing old methods. In the current era, the banking sector, a pillar of the global economy, faces a slew of issues.

- With the introduction of Artificial Intelligence (AI), financial institutions are devising novel solutions to age-old challenges. In this article, we will look at how AI Solve Problems In The Banking Industry.

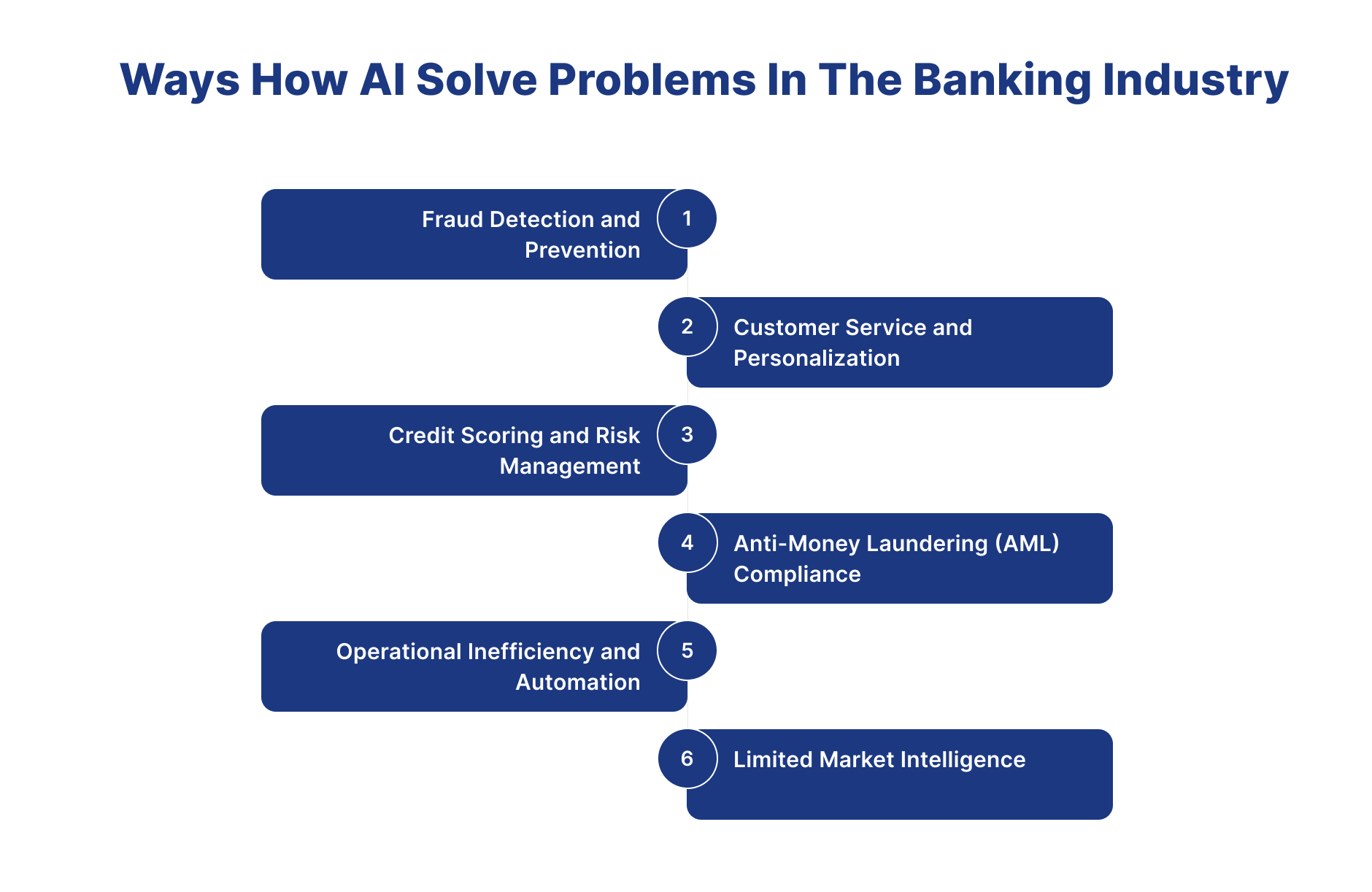

Ways How AI Solve Problems In The Banking Industry

1.Fraud Detection and Prevention

-

Before using AI, the banking industry faced a constant threat of fraud. Traditional techniques, which rely on static regulations and manual checks, have struggled to keep up with fraudsters' shifting strategies. Because of the limits of these tactics, financial institutions have become increasingly exposed to increasingly sophisticated assaults. Subtle patterns and abnormalities in massive databases proved difficult to detect, resulting in delayed reactions to growing fraud tendencies.

-

Introduce artificial intelligence-powered solutions. Machine learning algorithms and behavioral analytics have transformed fraud detection, allowing for a dynamic defense against new threats. Real-time analysis of massive datasets enabled banks to detect and prevent fraudulent actions, dramatically improving the industry's security posture. In this way, AI solve problems in the banking industry.

2.Customer Service and Personalization

-

Traditional approaches lacked the immediacy and personal touch to provide personalized and efficient client service. Manual procedures and rigid architecture made it difficult to respond to specific client demands and preferences, thus reducing overall customer satisfaction. Customer contacts were frequently impersonal, and responding to questions or concerns in real time was difficult.

-

The emergence of AI-powered chatbots and virtual assistants in the banking industry resulted in a paradigm change in client relations. Instant answers, job automation, and personalized suggestions became the norm, raising the bar for customer service and optimizing operational efficiency. In this way, AI solve problems in the banking industry.

3.Credit Scoring and Risk Management

-

While basic, traditional credit scoring algorithms sometimes lacked the complexity necessary for proper risk evaluations. Conventional techniques relied heavily on limiting characteristics such as credit history and income, leading to suboptimal lending decisions and a higher chance of default. With static scoring models, adapting to the changing financial situation and incorporating a larger variety of criteria was impossible.

-

AI has ushered in a data-driven revolution in credit scoring. AI-enabled models improved risk assessment accuracy by considering a greater variety of factors, including non-traditional data sources. Financial institutions may now make educated lending decisions, lowering the chance of default and optimizing risk management. In this way, AI solve problems in the banking industry.

4.Anti-Money Laundering (AML) Compliance

- Compliance with severe AML requirements was a problematic process that necessitated extensive human labor. Traditional approaches struggled to keep up with money launderers' ever-changing strategies, posing difficulties in maintaining regulatory compliance and deterring illicit financial activity. Manual transaction monitoring was time-consuming and sometimes prone to mistakes, making detecting minor patterns suggestive of money laundering activity difficult.

- AI has changed AML compliance by automating transaction monitoring, detecting patterns indicative of money laundering, and issuing alarms for further inquiry. AI systems' dynamic capabilities dramatically enhanced the efficiency of AML activities, allowing banks to keep ahead of growing regulatory requirements. In this way, AI solve problems in the banking industry.

5.Operational Inefficiency and Automation

-

Manual processes resulted in operational inefficiencies, with primary operations requiring substantial resources. The absence of automation hampered scalability and reactivity, providing issues adjusting to the financial landscape's expanding complexity. Manual procedures were time-consuming, prone to mistakes, and raised the possibility of operational bottlenecks.

-

Enter AI-powered robotic process automation (RPA) simplifies regular processes, decreases mistakes, and increases overall efficiency. Human resources have been freed up to concentrate on banking operations' more complicated and strategic parts. In this way, AI solve problems in the banking industry.

6.Limited Market Intelligence

-

Obtaining comprehensive market intelligence was a significant difficulty before the era of AI. Traditional market analysis approaches were frequently restricted in scope, making it difficult for financial institutions to obtain timely and reliable insights into industry trends, competitor activity, and new prospects.

-

AI-powered predictive analytics and natural language processing enable financial institutions to extract insights from massive datasets, allowing for better-educated investment strategies and risk management choices. In this way, AI solve problems in the banking industry.

Conclusion

- AI has emerged as a change agent in the banking industry, overcoming previously intractable difficulties. AI has become vital, from reinforcing security measures to optimizing operational efficiency, revolutionizing consumer relationships, maintaining regulatory compliance, and increasing market intelligence. As financial institutions adopt revolutionary technology, the banking sector enters a new era distinguished by innovation, resilience, and a renewed emphasis on customer-centric solutions. The AI revolution is altering the future of banking, not merely solving obstacles.

How Digiqt will help you adapt AI in your company

-

At Digiqt, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients with monthly updates on the software development progress.

-

Digiqt's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

What are AI Solve Problems In The Banking Industry?

AI Solve Problems In The Banking Industry are AI-powered systems that automate and optimize processes using machine learning, natural language processing, and intelligent decision-making capabilities.

How do AI Solve Problems In The Banking Industry work?

AI Solve Problems In The Banking Industry work by analyzing data, learning patterns, and executing tasks autonomously while integrating with existing systems to streamline operations and improve efficiency.

What are the benefits of using AI Solve Problems In The Banking Industry?

The benefits include increased efficiency, reduced operational costs, improved accuracy, 24/7 availability, better customer experience, and data-driven insights for decision-making.