6 ways how implementation of AI is revolutionizing payment industry

AI is viewed in this context as a revolutionary advance altering the payment industry. This blog will explore how AI is revolutionizing the payment industry.

Introduction

- Artificial intelligence (AI) has been gaining speed quickly in recent years and is changing several sectors, including the payments sector. By implementing AI, financial institutions and payment service providers may now improve fraud detection, optimize operations, and get never-before-seen insights into client behavior. This change will make Processing payments quicker, safer, and more effective. The application of AI is viewed in this context as a revolutionary advance that is altering the payment industry's terrain.in this blog, we will explore how AI is revolutionizing the payment industry.

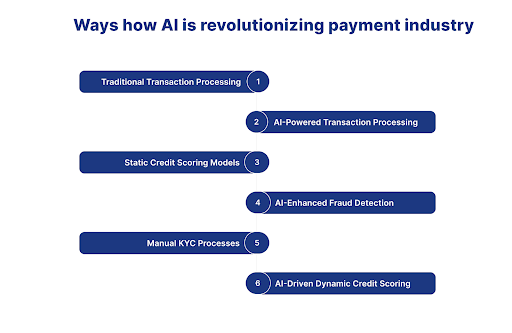

Ways how AI is revolutionizing payment industry

1. Before AI: Traditional Transaction Processing

-

Before: Manual procedures dominated the landscape, leading to delays, inaccuracies, and scalability difficulties. Errors inherent to manual handling introduced inaccuracies into financial records.

-

After: AI-driven transaction processing arises, employing advanced algorithms to assure quick, error-free, and highly scalable procedures, drastically changing the old transaction paradigm. In this way, AI is revolutionizing the payment industry.

2. Implementation 1: AI-Powered Transaction Processing

- Before: reactive fraud prevention solutions failed to keep up with new fraud strategies, and rule-based systems were ineffective against new and sophisticated fraud patterns.

- After: AI-enhanced fraud detection takes center stage, allowing for real-time risk assessment. Machine learning algorithms adapt to new fraud patterns, lowering fraud rates and improving security measures. In this way, AI is revolutionizing the payment industry.

3. Static Credit Scoring Models Before AI

-

Before: out-of-date credit scoring methods generated static and sometimes erroneous risk evaluations, static models lacked adaptability and failed to capture real-time changes in creditworthiness.

-

After: AI-driven dynamic credit scoring enters the scene, altering the industry by merging real-time data analysis and machine learning algorithms. This ensures exact, up-to-date creditworthiness ratings that respond to shifting financial patterns. In this way, AI is revolutionizing payment industry.

4. Implementation 2: AI-Enhanced Fraud Detection

-

Before: Traditional approaches grappled with the challenge of keeping up with rapidly evolving fraud tactics. Reactive methods and delayed detection were prevalent.

-

After: AI's adaptive capabilities shine as it continuously learns and evolves to detect and prevent fraud in real time. This dynamic approach enhances security measures and positions the payment industry at the forefront of fraud prevention. In this way, AI is revolutionising payment industry.

5. Before AI: Manual KYC Processes

-

Before: Know Your Customer (KYC) processes were manual, time-consuming, and prone to errors. Manual verification led to inefficiencies and potential errors.

-

After: AI steps in to automate KYC procedures, streamlining onboarding processes, ensuring accuracy, and enhancing compliance with regulatory requirements. This results in a seamless and efficient customer experience. by this way, AI is revolutionizing payment industry.

6. Implementation 3: AI-Driven Dynamic Credit Scoring

-

Before: static credit scoring algorithms needed more agility, presenting an incomplete picture of an individual's creditworthiness. Limited adaptability and responsiveness hindered accurate credit assessments.

-

After: AI-driven dynamic credit scoring takes center stage, deploying advanced algorithms to adapt to shifting financial patterns. This guarantees that lenders make educated judgments in real-time, enabling a more dynamic and responsive lending economy. Ensures that lenders make informed, real-time decisions, fostering a more active and responsive lending ecosystem. In this way, AI is revolutionising payment industry.

Conclusion

- The payment industry's transition from traditional methodologies to AI-driven innovations is a revolution. These implementations, spanning transaction processing, fraud detection, and credit scoring, showcase a paradigm shift towards a more dynamic, responsive, and technologically advanced future in the world of payments. Integrating AI enhances efficiency and creates a more secure, adaptive, and customer-centric financial ecosystem.

How Digiqt will help you adapt AI in the sales department

-

At Digiqt, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients with monthly updates on the software development progress.

-

Digiqt's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

What are 6 ways how implementation of AI is revolutionizing payment industry?

6 ways how implementation of AI is revolutionizing payment industry are AI-powered systems that automate and optimize processes using machine learning, natural language processing, and intelligent decision-making capabilities.

How do 6 ways how implementation of AI is revolutionizing payment industry work?

6 ways how implementation of AI is revolutionizing payment industry work by analyzing data, learning patterns, and executing tasks autonomously while integrating with existing systems to streamline operations and improve efficiency.

What are the benefits of using 6 ways how implementation of AI is revolutionizing payment industry?

The benefits include increased efficiency, reduced operational costs, improved accuracy, 24/7 availability, better customer experience, and data-driven insights for decision-making.