AI is revolutionizing lending here’s why borrowers love it!

AI is revolutionizing the lending industry by enhancing operations and resolving past issues faced by both borrowers and lenders

Introduction

- In recent years, AI has been Revolutionizing Lending industry. This technology revolution has expedited operations and effectively solved the numerous issues that both borrowers and lenders experienced in the past. In this blog article, we will look at the specific difficulties that have plagued the loan sector and how AI has brought in previously considered unattainable solutions.

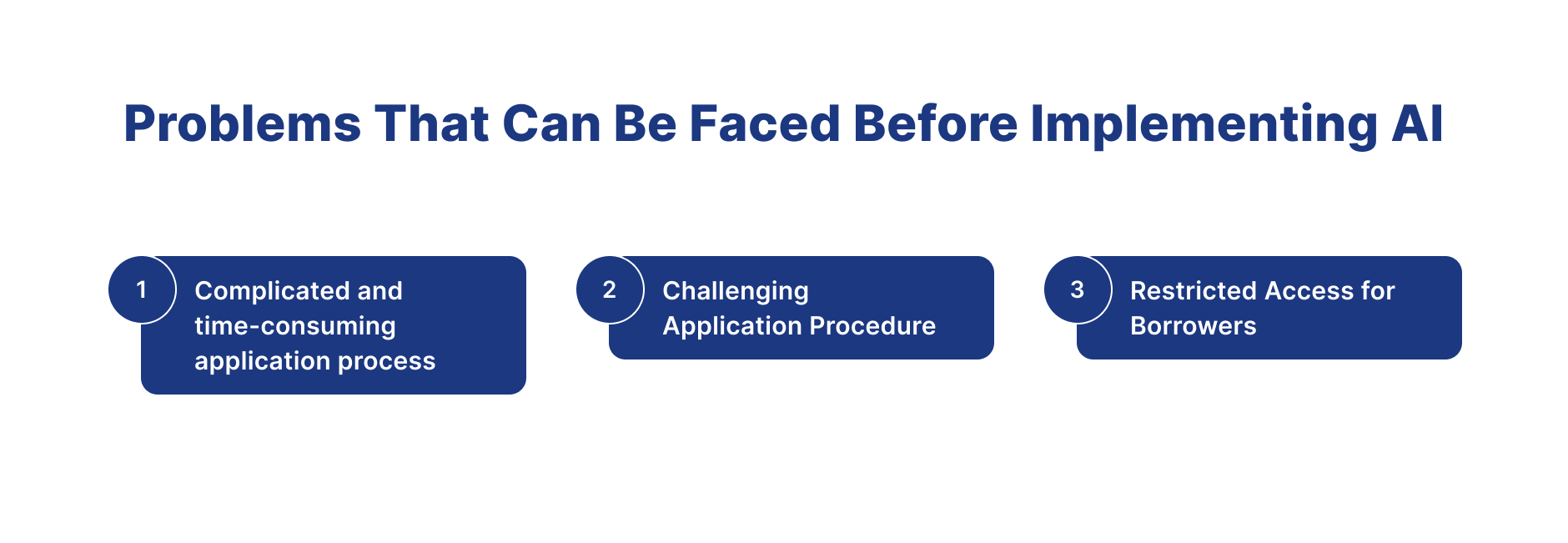

Problems that can be faced before implementing AI

1.Complicated and time-consuming application process

- Borrowers used to hate the application procedure in the pre-AI age of lending. Prospective loan applicants had to wade through a maze of paperwork, presenting physical papers that frequently stretched multiple pages. Manual verification methods, such as credit checks and job verification, added significant time to the application timeframe. The procedure was time-consuming and prone to mistakes, with missing paperwork and manual supervision leading to additional delays. Borrowers found themselves in a frustrating loop where searching for financial aid became an uphill fight against bureaucracy and slowness.

2.Challenging Application Procedure

- Before AI, if a borrower wanted a loan from a lender, they had to fill out a form given by the lender's organization. The borrower was required to provide basic information on this form. The completed form had to be delivered to the lender's company, where an employee would check its contents. The lender would also look at the borrower's credit score. Based on these details, the employee would decide on loan acceptance. Borrowers' loan disbursements were delayed due to the time-consuming application process.

3.Restricted Access for Borrowers

- Before AI, customers had to physically visit the branches to obtain information on loan amounts, interest rates, needed paperwork in the loan procedure, etc. Employees occasionally could not offer detailed answers, requiring borrowers to return to the location often. If a borrower wanted information on a public holiday, lender branches could not assist owing to the holiday.

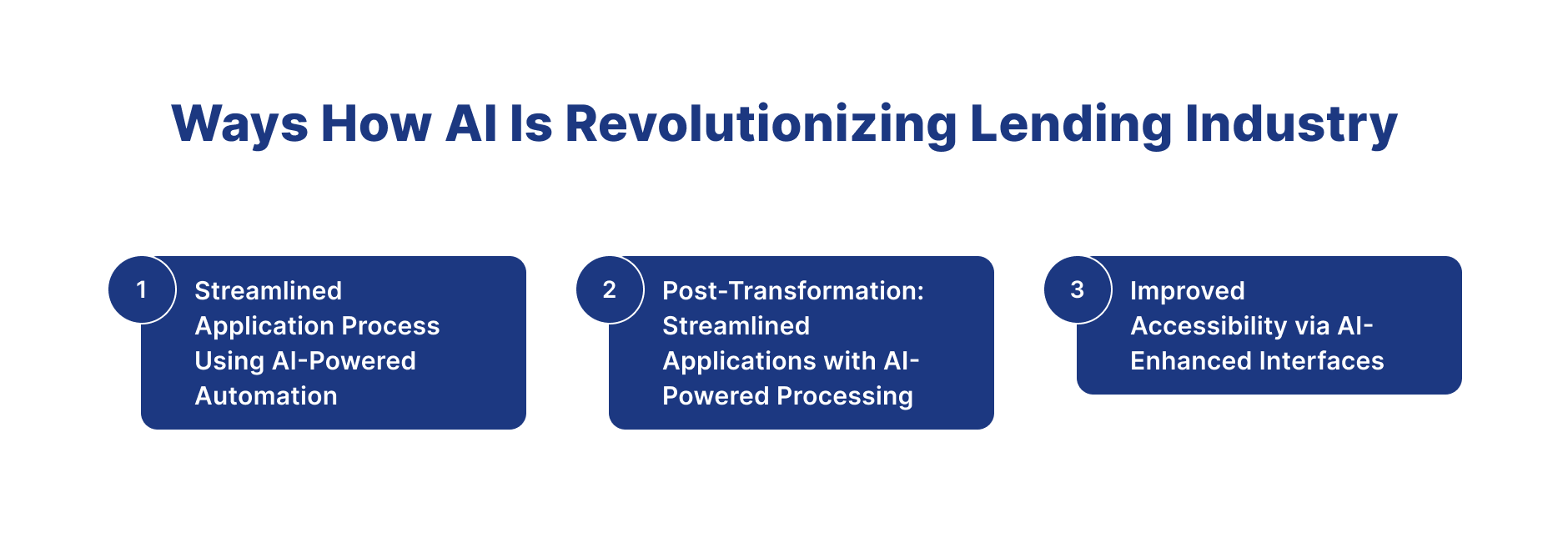

ways how AI is Revolutionizing Lending industry

1.Streamlined Application Process Using AI-Powered Automation

- Ai is Revolutionizing Lending industry by addressing the laborious and time-consuming aspect that borrowers previously faced. AI-powered automation has expedited the application process, from document submission to acceptance. Machine learning algorithms now handle document verification, credit checks, and other critical stages quickly and precisely. This speeds up the review process and considerably minimizes the possibility of mistakes, which is typical in traditional operations. Borrowers now have a simplified and simple application procedure, a far cry from the days of paperwork-induced aggravation.

2.Post-Transformation: Streamlined Applications with AI-Powered Processing

- AI is the efficiency pioneer. AI algorithms have transformed the lending landscape. Intelligent application procedures enabled by artificial intelligence (AI) examine large datasets quickly and automate creditworthiness and financial credentials assessment. A slick, user-friendly application experience that turns a time-consuming chore into a quick and simple one.

3.Improved Accessibility via AI-Enhanced Interfaces

- With the arrival of chatbots and AI-powered interfaces, the way borrowers obtain information has been completely transformed. Through the use of machine learning and natural language processing, these interfaces help borrowers through the financing process, make tailored advice, and respond to queries quickly. As a result, information barriers are removed, promoting financial inclusion and providing a more accessible and user-friendly experience.

Conclusion

-

In conclusion, incorporating Artificial Intelligence into the loan business has solved long-standing issues and ushered in an era of unparalleled efficiency, precision, and security also Ai is Revolutionizing Lending industry. The time-consuming application procedure is now a thing of the past, replaced with a simplified and automated approach. Credit scoring algorithms have improved the industry's capacity to analyze risk, resulting in better-informed lending choices and decreased default rates.

-

The proactive nature of AI-driven fraud detection assures a strong defense against developing threats, offering a safer environment for both lenders and borrowers. As technology advances, the coupling of AI and lending holds the possibility of continuing innovation, crafting a future in which financial resources are more equitable, accessible, and secure for everyone involved.

How Digiqt will help you adapt AI in your company

-

At Digiqt, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients monthly updates on the software development progress.

-

Digiqt's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

What are AI is revolutionizing lending here’s why borrowers love it!?

AI is revolutionizing lending here’s why borrowers love it! are AI-powered systems that automate and optimize processes using machine learning, natural language processing, and intelligent decision-making capabilities.

How do AI is revolutionizing lending here’s why borrowers love it! work?

AI is revolutionizing lending here’s why borrowers love it! work by analyzing data, learning patterns, and executing tasks autonomously while integrating with existing systems to streamline operations and improve efficiency.

What are the benefits of using AI is revolutionizing lending here’s why borrowers love it!?

The benefits include increased efficiency, reduced operational costs, improved accuracy, 24/7 availability, better customer experience, and data-driven insights for decision-making.