5 problems that can be solved by implementing AI in the home loan process

the use of AI in the home loan process is revolutionizing how we make our way through this important financial trip.

Introduction

- Historically, the house loan application process has been tainted by inefficiencies and complications while being a crucial step towards achieving the goal of homeownership. But the use of AI in the home loan process is revolutionizing how we make our way through this important financial trip. Let's examine the difficulties in the house loan application process before AI's introduction and how it is transforming this procedure.

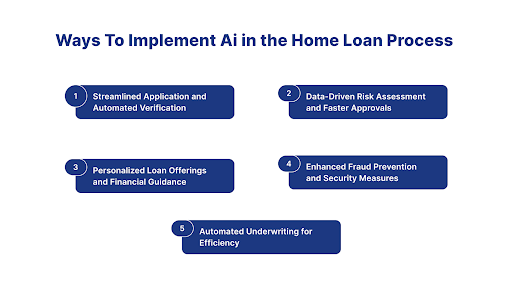

Ways To Implement Ai in the Home Loan Process

1.Streamlined Application and Automated Verification

-

A lot of paperwork and laborious document verification frequently marked the application procedure for a home loan. There were delays and frustrations for the borrowers as a result of the difficult work of obtaining and submitting a multiplicity of documentation. Loan approval wait times were prolonged as a result of the laborious manual review procedures.

-

Applying for a house loan has changed dramatically since implementing AI in the home loan process. Because AI algorithms automate document verification, borrowers may take advantage of quicker application procedures. With optical character recognition (OCR) technology, pertinent information may be quickly extracted from documents, cutting down on the time needed to approve a loan.

2.Data-Driven Risk Assessment and Faster Approvals

-

Conventional techniques for evaluating risk in house loans were frequently based on credit scores and historical data, making them subjective. This caused delays and, occasionally, unjust denials for borrowers who, according to conventional standards, could have been deemed high-risk.

-

Implementing AI in the home loan process can assess the risk by examining a wide range of data sources outside credit ratings. Analyzing purchasing trends, job history, and even social media activity falls under this category. Consequently, the lending process becomes more inclusive and expedites loan approvals by making the risk evaluation more impartial and precise.

3.Personalized Loan Offerings and Financial Guidance

-

Applicants for home loans frequently encountered a lack of customization in their lending experience. Borrowers felt overburdened and neglected by generic loan offers and inadequate assistance navigating the confusing mortgage possibilities.

-

AI-powered platforms use data analytics to provide individualized loan packages based on each borrower's financial objectives and profile. Furthermore, implementing AI in the home loan process enabled chatbots and virtual assistants to give borrowers real-time assistance by responding to their questions and providing information about the best loan possibilities. The borrower's comprehension of the process is improved by this individualized approach, which promotes better decision-making.

4.Enhanced Fraud Prevention and Security Measures

-

The lack of adequate fraud detection procedures made the home loan application process vulnerable to fraudulent activity. Lenders and borrowers were placed in danger when manual audits and rule-based systems could not keep up with the rapid evolution of fraud strategies.

-

AI uses sophisticated machine learning algorithms to find trends and abnormalities that point to fraud. Implementing AI in the home loan process has strengthened the entire security of the home loan process by verifying identities and monitoring transactions, therefore offering a strong defense against attacks.

5.Automated Underwriting for Efficiency

- The home loan industry's traditional underwriting procedure was a maze of intricate procedures characterized by manual evaluations of financial documentation and several approval stages. Borrowers often had Long wait periods while their applications were processed through the convoluted underwriting process. This method was labor-intensive, which raised the chance of mistakes and inconsistencies in assessing the borrower's financial viability and contributed to delays.

- Implementing AI in the home loan process has made A paradigm change in the house loan underwriting process as a result of the incorporation of Artificial Intelligence (AI), which has reduced the complexity and time-consuming nature of old techniques. The whole underwriting process—from the first document submission to the latter stages of approval—is streamlined by AI-driven automation.

Conclusion

- An important turning point in the development of the mortgage sector has been reached with the integration of AI in the home loan process. AI is bringing in a new era of speed, transparency, and personalized financial experiences for home loan applicants by tackling issues with drawn-out application procedures, subjective risk assessments, lack of personalization, and insufficient fraud detection. As we transition from antiquated methods to a technologically sophisticated future, the home loan process is becoming more convenient, safe, and customized to meet every borrower's individual requirements.

How Digiqt will help you adapt AI in your company

-

At Digiqt, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients with monthly updates on the software development progress.

-

Digiqt's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

What are 5 problems that can be solved by implementing AI in the home loan process?

5 problems that can be solved by implementing AI in the home loan process are AI-powered systems that automate and optimize processes using machine learning, natural language processing, and intelligent decision-making capabilities.

How do 5 problems that can be solved by implementing AI in the home loan process work?

5 problems that can be solved by implementing AI in the home loan process work by analyzing data, learning patterns, and executing tasks autonomously while integrating with existing systems to streamline operations and improve efficiency.

What are the benefits of using 5 problems that can be solved by implementing AI in the home loan process?

The benefits include increased efficiency, reduced operational costs, improved accuracy, 24/7 availability, better customer experience, and data-driven insights for decision-making.