AI In Payment Industry: 6 Problems That Can Be Solve By Implementing AI In The Payment Industry

the payment sector is at the forefront of revolutionary advances, driven mainly by the strategic use of AI in payment industry.

Introduction

- In the dynamic world of digital transactions, the payment sector is at the forefront of revolutionary advances, driven mainly by the strategic use of AI in payment industry. This blog methodically explores 6 significant obstacles that have plagued the payment business and gives an in-depth study of how AI has not only handled these concerns but has fundamentally revolutionized the industry. The Before and After Bridge Content Strategy framework will serve as our guide, helping us to negotiate the many stages of the industry's programme.

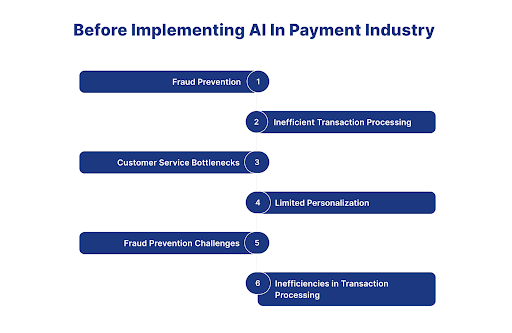

Before Implementing AI In Payment Industry

1. Fraud Prevention:

- Before the advent of AI, fraud protection in the payment sector depended on traditional rule-based systems and manual monitoring. However, these solutions were reactive and needed to catch up with the increasingly complex strategies used by cybercriminals. Financial institutions experienced severe vulnerabilities, resulting in significant economic losses and compromising security.

2. Inefficient Transaction Processing:

- In the pre-AI period, traditional payment systems were hampered by inefficient transaction processing. The antiquated infrastructure and incapacity caused delays and bottlenecks in managing the increasing number of transactions. This significantly inhibited the industry's capacity to supply the immediate and dependable services consumers need in the quickly developing digital world.

3. Customer Service Bottlenecks:

- Before AI, customer service was a bottleneck in the payment process. Human-intensive query, dispute, and problem resolution resulted in longer wait times, rising operating expenses, and dissatisfied consumers. This not only harmed the industry's image for rapid issue response, but it also hampered the overall customer experience.

4. Limited Personalization:

- Before AI, a significant disadvantage in payment systems was the lack of customization. The experiences were generic, unable to engage people on a personal basis. The sector needed to personalize its services to individual interests, restricting its capacity to engage and keep a broad customer base.

5.Fraud Prevention Challenges:

- Before AI, the payment industry battled with fraud protection utilizing outmoded rule-based systems. Fraud detection was primarily reactive, depending on established procedures that frequently failed to keep up with emerging cyber threats. This increased susceptibility to sophisticated fraud strategies, resulting in financial losses and degraded security.

6. Inefficiencies in Transaction Processing:

- Traditional payment systems had inefficiencies in transaction processing before AI. The present infrastructure cannot manage the increasing number of transactions, resulting in delays and bottlenecks. The sector needed help to supply the quick and dependable services users need in the fast-growing digital ecosystem.

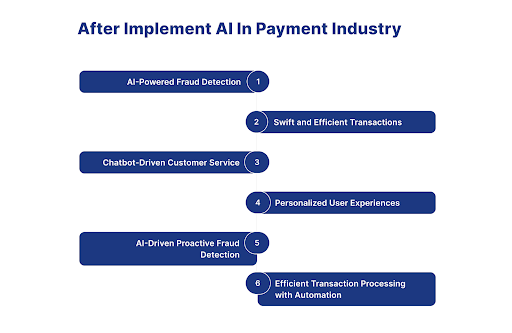

After Implement AI In Payment Industry

1. AI-Powered Fraud Detection:

- The use of AI in payment industry has ushered in a new age in fraud prevention. Advanced machine learning algorithms examine massive datasets in real time, enabling preemptive identification of fraudulent behaviors. This game-changing technique has drastically decreased financial losses and increased overall security in the payment sector.

2. Swift and Efficient Transactions:

- Ai in payment industry has ushered in a fundamental change in transaction processing. Automation, enabled by machine learning algorithms, guarantees fast and dependable transaction processing. The sector runs smoothly, satisfying the demands of a changing digital economy and improving overall user experience.

3. Chatbot-Driven Customer Service:

- AI in payment industry has revolutionized customer support with the rise of intelligent chatbots. These virtual assistants act as a powerhouse for instant help, providing swift answers to inquiries and resolving issues at lightning speed. This AI-powered approach streamlines problem solving and elevates user experience, creating a smooth and seamless journey for payment users.

4. Personalized User Experiences:

- Following deployment, AI in payment industry monitor user behavior and transaction history, enabling tailor-made experiences. From targeted marketing to personalized advice, this AI-powered approach engages consumers on an individual level, fostering happiness and loyalty. This not only boosts the user experience but also unlocks new opportunities for cross-selling and upselling.

5. AI-Driven Proactive Fraud Detection:

- The incorporation of AI in payment industry has transformed fraud prevention. Advanced machine learning algorithms now examine massive datasets in real-time, allowing for preemptively identifying fraudulent behaviors. The sector has transitioned from a reactive to a proactive posture, significantly decreasing financial losses and strengthening overall security.

6. Efficient Transaction Processing with Automation:

- Transaction processing has experienced a paradigm shift thanks to the transformative power of AI in payment industry. Machine learning algorithms automate tasks, leading to lightning-fast and efficient transaction processing. This AI-powered landscape thrives in the dynamic digital economy, offering users a dependable and rapid payment experience every time.

Conclusion

- This blog has shed light on the payment industry's transformational path thanks to the rigorous analysis offered by the Before and After Bridge Content Strategy methodology. AI's strategic deployment has handled 6 problems and transformed the industry, placing it as a leader in technological innovation. The sector is currently at the vanguard of a future in which efficiency, security, and customization live together, all powered by the transformational potential of ai in payment industry.

How Digiqt will help you adapt AI in the sales department

-

At Digiqt, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients with monthly updates on the software development progress.

-

Digiqt's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

What are AI In Payment Industry?

AI In Payment Industry are AI-powered systems that automate and optimize processes using machine learning, natural language processing, and intelligent decision-making capabilities.

How do AI In Payment Industry work?

AI In Payment Industry work by analyzing data, learning patterns, and executing tasks autonomously while integrating with existing systems to streamline operations and improve efficiency.

What are the benefits of using AI In Payment Industry?

The benefits include increased efficiency, reduced operational costs, improved accuracy, 24/7 availability, better customer experience, and data-driven insights for decision-making.