7 Challenges & Benefits of AI in Automatic Invoice Processing

AI in Automatic Invoice Processing represents a paradigm shift in financial processes.

Introduction

- AI in Automatic Invoice Processing represents a paradigm shift in financial processes. Handling invoices has traditionally been labour-intensive and error-prone, fraught with difficulties caused by format variety, unstructured data, and regulatory compliance requirements. The introduction of AI promises to transform this environment by offering automation, efficiency, and a better degree of accuracy. However, integrating AI into automatic invoice processing is not without obstacles, ranging from responding to fluctuating data quality to guaranteeing smooth coordination with older systems. In this context, this debate digs into the challenges and advantages of implementing AI in automatic invoice processing, covering the complex nuances of each component.

Contents

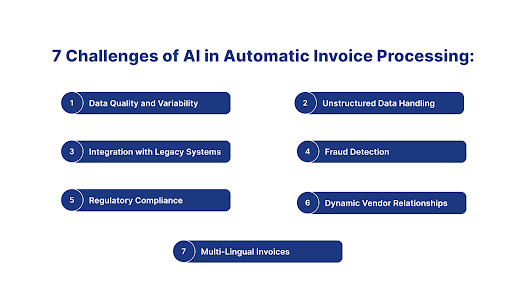

7 Challenges of AI in Automatic Invoice Processing:

1. Data Quality and Variability:

- Challenges: The different types of invoices businesses receive create complicated data quality and unpredictability difficulties. AI models have challenges due to layouts, formats, languages, and data quality differences. Preprocessing is essential for standardizing and improving data quality, guaranteeing correct extraction.

2. Unstructured Data Handling:

- Challenges Unstructured data adds complexity, like free-form writing or non-standardized descriptions. AI models must apply powerful natural language processing (NLP) approaches to perceive and interpret unstructured materials effectively. Image recognition systems are also essential for processing bills with graphical content.

3. Integration with Legacy Systems:

- Challenges Integrating AI into existing legacy systems necessitates overcoming technical obstacles. Compatibility concerns, data migration challenges, and opposition to change from existing practices can all stymie AI integration. A deliberate approach to infrastructure changes, API development, and addressing interoperability issues is required.

4. Fraud Detection:

- Challenges: Because fraudulent operations are dynamic, AI systems must constantly develop. Detecting minor irregularities and unusual patterns necessitates a thorough awareness of emerging fraud methods. Access to various datasets and flexible algorithms capable of fast modifications is critical for efficient fraud detection.

5. Regulatory Compliance:

- Challenges: Achieving and maintaining compliance with various regulatory requirements is a constant task. Dynamic rule-sets inside AI models are required for interpreting rules, verifying conformance, and adjusting quickly to changes in compliance frameworks. Regular updates and effective monitoring techniques are essential.

6. Dynamic Vendor Relationships:

- Challenges: The changing nature of vendor connections complicates computerized invoice processing. Changes in pricing structures, vendor data, or contractual conditions can all put AI systems to the test. Continuous adaptation and learning processes are necessary to correctly understand and process invoices reflecting changing vendor relationships.

7. Multi-Lingual Invoices:

- Challenges: Dealing with invoicing in different languages adds another degree of complication. AI models must be adept in language translation, contextual comprehension, and language-specific subtleties. Ensuring reliable data extraction and interpretation across varied linguistic situations becomes critical.

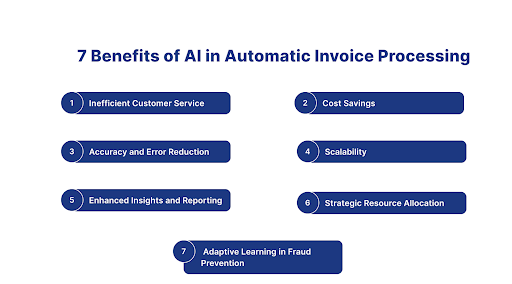

Benefits of AI in Automatic Invoice Processing:

1.Increased Efficiency:

- Benefits: AI in automatic invoice processing improves efficiency by automating time-consuming operations. Intelligent data extraction and automated validation and approval procedures speed up invoice processing. This improves operating speed, removes bottlenecks, and assures timely payments.

2.Cost Savings:

- Benefits: Using AI in automatic invoice processing results in considerable cost reductions. Reducing manual interventions, minimizing mistakes associated with repeated processes, and optimizing resource allocation all contribute to operational cost reductions. Organizations allocate resources to strategic objectives.

3.Accuracy and Error Reduction:

- Benefits: After extensive training and optimization, AI systems display astonishing accuracy in data extraction. This precision ensures the correctness of financial records by minimizing mistakes associated with human data entry. As a result, financial reporting has improved, and inconsistencies have decreased.

4.Scalability:

- Benefits: The inherent scalability of AI in automatic invoice processing enables firms to manage rising invoice quantities effortlessly. Businesses may extend their automatic invoice processing capabilities without incurring a linear rise in resource needs, allowing them to react to increasing workloads without sacrificing efficiency.

5.Enhanced Insights and Reporting:

- Benefits: AI in automatic invoice processing empowers organizations to extract actionable insights from invoice data. An in-depth analysis of spending patterns, vendor behaviours, and financial trends provides a holistic view of economic dynamics. These insights support data-driven decision-making, strategic planning, and proactive financial management.

6.Strategic Resource Allocation:

- Benefits: AI in automatic invoice processing provides strategic resource allocation in addition to cost reductions. With regular and repetitive work automated, human resources may be allocated toward strategic efforts such as financial analysis, vendor negotiations, and process optimization, boosting overall organizational effectiveness.

7.Adaptive Learning in Fraud Prevention:

- Benefits: AI in automatic invoice processing may learn and grow adaptively in response to evolving fraud tendencies. Continuous monitoring and machine learning algorithms enable real-time updates to fraud detection measures. This proactive strategy improves the organization's capacity to remain ahead of emerging fraudulent operations.

Conclusion

- Finally, the issues of data unpredictability, unstructured information, integration complications, fraud detection, and compliance are tackled with creative solutions in the form of AI-driven automatic invoice processing. The advantages of greater productivity, cost reductions, accuracy improvements, scalability, and enhanced insights highlight the revolutionary potential of using AI in financial processes. As technology advances, these advantages will become more widespread, altering the landscape of computerized invoice processing.

How Digiqt will help you adapt AI in the sales department

-

At Digiqt, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients with monthly updates on the software development progress.

-

Digiqt's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Frequently Asked Questions

What are 7 Challenges & Benefits of AI in Automatic Invoice Processing?

7 Challenges & Benefits of AI in Automatic Invoice Processing are AI-powered systems that automate and optimize processes using machine learning, natural language processing, and intelligent decision-making capabilities.

How do 7 Challenges & Benefits of AI in Automatic Invoice Processing work?

7 Challenges & Benefits of AI in Automatic Invoice Processing work by analyzing data, learning patterns, and executing tasks autonomously while integrating with existing systems to streamline operations and improve efficiency.

What are the benefits of using 7 Challenges & Benefits of AI in Automatic Invoice Processing?

The benefits include increased efficiency, reduced operational costs, improved accuracy, 24/7 availability, better customer experience, and data-driven insights for decision-making.