AI in Account Management: What’s Next for Banks?

The banking sector is changing due to the use of AI in account management, which offers many advantages, from improved security to individualized client experiences.

Introduction

- Managing and maintaining customer accounts, transactions, and financial data is the responsibility of account management, a crucial role in the banking industry. This procedure has always been laborious and manual, which might cause mistakes and administrative difficulties. However, the emergence of artificial intelligence (AI) presents fascinating chances to transform account management in the banking industry.

- In this article, we will examine the several ways that AI in account management in the banking industry. AI can improve customer services by streamlining procedures, increasing accuracy, and detecting fraud. Examples of these applications include automated data input and reconciliation, fraud detection, and personalized customer experiences.

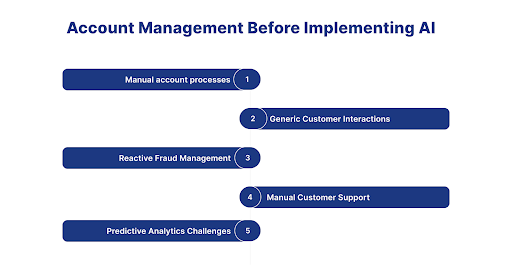

Account Management Before Implementing AI

1.Manual account processes

- Before using AI In Account Management, many manual processes were used for account administration. Data input, document verification, and compliance checks were labor-intensive and error-prone tasks. These manual systems' inefficiencies made them difficult to scale and made it difficult to adjust to a changing financial environment. Since then, the development of AI has completely changed these procedures, automating work and greatly increasing account management efficiency.

2.Generic Customer Interactions

- Before using AI in account management, banking client interactions were impersonal and generic. Implementing a uniform strategy impeded the delivery of focused guidance and personalized resolutions, restricting the comprehensive client experience. Banks found it challenging to contact clients personally, given the lack of advanced analytics, which led to standardized encounters. Since then, the advent of AI has changed this environment, enabling more meaningful and customized consumer interactions.

3.Reactive Fraud Management

- Before implementing AI In Account Management, fraud management was reactive. Financial institutions did not have real-time surveillance; they responded to fraudulent instances after they happened. This method necessitated time-consuming investigations since it exposed consumer accounts to financial losses and unauthorized access. This has changed with the advent of AI, allowing for more effective fraud prevention and management through proactive measures and real-time monitoring.

4.Manual Customer Support

- Before the integration of AI In Account Management, customer service in banking was provided by hand, resulting in resource-intensive interactions and extended response times. Lack of automation led to inefficiencies and delays, which hindered the capacity to scale and consistently meet client expectations. This environment has changed dramatically with the advent of AI, which makes it possible to send automatic and rapid replies, greatly enhancing the efficacy and efficiency of customer support operations.

5.Predictive Analytics Challenges

- Predictive analytics encountered difficulties before the inclusion of AI In Account Management. The ability of traditional systems to anticipate client behavior and provide proactive support was restricted. Reliance on past data limited insights for proactive solutions and made responding to changing client demands more difficult. Since then, artificial intelligence (AI) has revolutionized this, providing more accurate predictive analytics and enabling banks to effectively provide personalized, future-focused services.

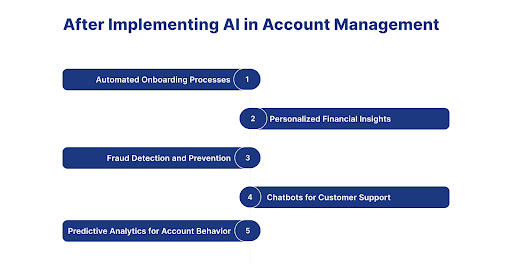

After Implementing AI in Account Management

1.Automated Onboarding Processes

- Automating client onboarding procedures is one of the main areas where AI has a big influence. AI algorithms can speed up the account creation process while guaranteeing compliance with regulations by streamlining identity verification, document processing, and compliance checks. This improves consumer satisfaction while simultaneously increasing operational efficiency.

2.Personalized Financial Insights

- Personalized financial insights may be produced using AI-powered analytics to examine transaction data and consumer behavior. Banks can provide individualized advice and product suggestions by getting to know each customer's spending patterns, savings habits, and investment preferences. Increased consumer loyalty and engagement are fostered by this degree of personalization.

3.Fraud Detection and Prevention

- Integrating AI in account management makes real-time fraud detection and prevention possible. Machine learning algorithms are capable of detecting suspicious activity and stop unauthorized account access by analyzing transaction patterns. Financial fraud is prevented, and consumer account security is improved by taking preventative measures.

4.Chatbots for Customer Support

- AI-powered chatbots are essential for enhancing account management and customer service. These virtual assistants can respond to standard questions, give balance details, and assist clients with simple account procedures. Chatbots provide immediate answers, reducing wait times and raising client satisfaction levels.

5.Predictive Analytics for Account Behavior

- Banks may use AI In Account Management to use predictive analytics to forecast the behavior and preferences of their customers. By evaluating existing data, artificial intelligence (AI) systems can predict future financial activity, such as impending invoices or possible account overdrafts. This enables banks to provide clients with proactive assistance and pertinent financial solutions.

Conclusion

- The banking industry is changing due to the use of AI in account management, which offers many advantages, from improved security to individualized client experiences. Even more efficiency, creativity, and customer happiness are anticipated in account management in the future as financial institutions continue to use these technologies. By utilizing AI, banks may put themselves at the forefront of a customer-focused and technologically sophisticated financial sector.

How Digiqt will help you adapt AI in your company

-

At Digiqt, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients with monthly updates on the software development progress.

-

Digiqt's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

What are AI in Account Management?

AI in Account Management are AI-powered systems that automate and optimize processes using machine learning, natural language processing, and intelligent decision-making capabilities.

How do AI in Account Management work?

AI in Account Management work by analyzing data, learning patterns, and executing tasks autonomously while integrating with existing systems to streamline operations and improve efficiency.

What are the benefits of using AI in Account Management?

The benefits include increased efficiency, reduced operational costs, improved accuracy, 24/7 availability, better customer experience, and data-driven insights for decision-making.