AI In FinTech Industry: 7 Ways Of Implementing AI To Empower The FinTech Industry

AI in FinTech industry is quickly transforming, changing the way financial services are designed, provided, and experienced

Introduction

AI in FinTech industry is quickly transforming, changing the way financial services are designed, provided, and experienced. Fintech businesses use this potent technology to create ground-breaking products, automate tedious operations, and improve consumer relations to never-before-seen levels.

Artificial Intelligence is also changing customer care services. Intelligent chatbots and virtual assistants are taking the place of traditional contact centers. These AI-powered workers work around the clock, offering individualized assistance, responding to inquiries quickly, and effectively handling problems. The relationship between fintech businesses and their clients is getting stronger due to this improved responsiveness and accessibility, which is encouraging more consumer satisfaction and loyalty.

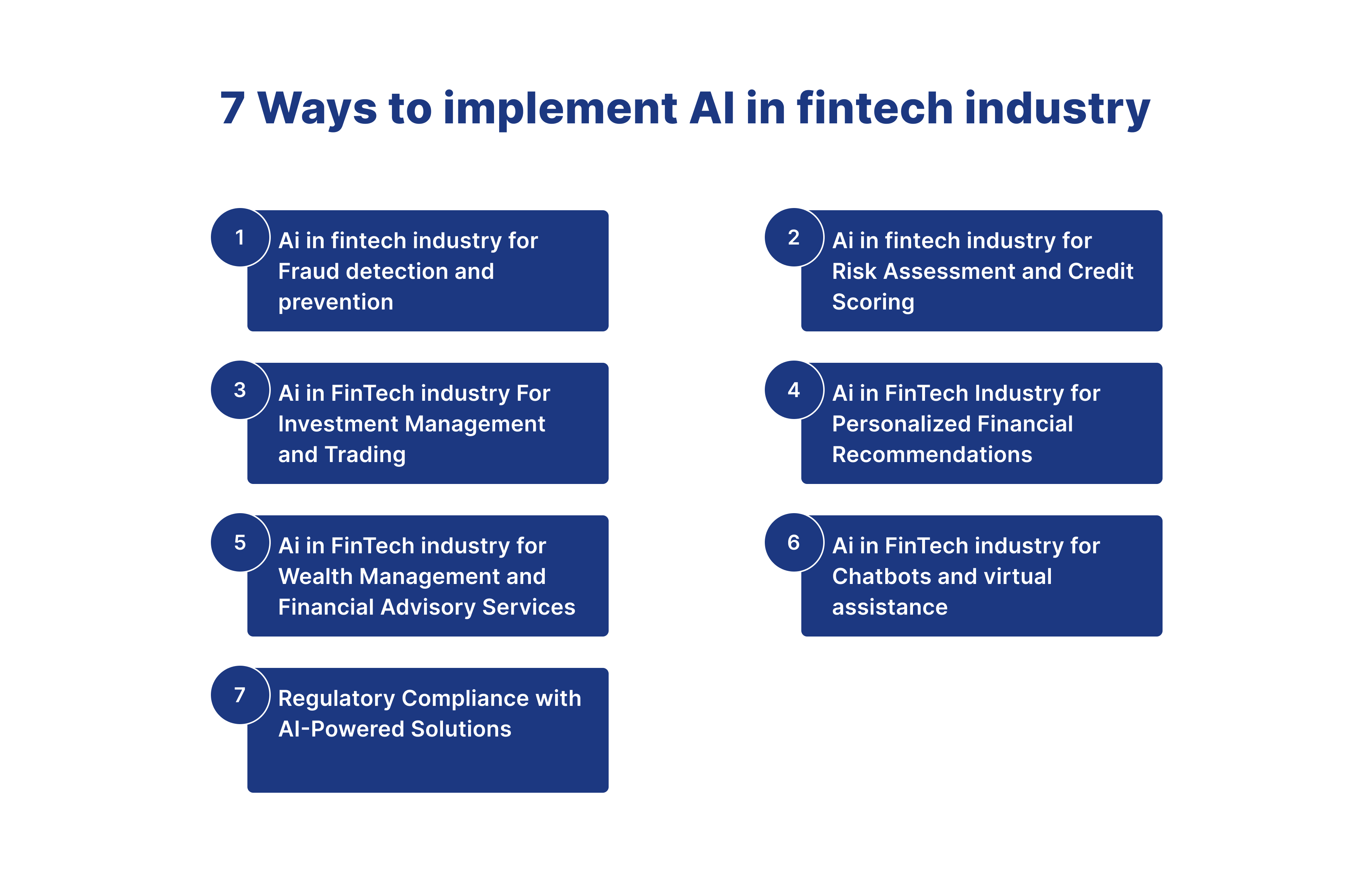

Ways to implement AI in fintech industry

1.Ai in fintech industry for Fraud detection and prevention

-

Fraudulent activities significantly threaten the financial sector, causing substantial losses and undermining customer trust. AI algorithms can analyze massive amounts of transactional data, identifying anomalies and patterns that indicate fraudulent behavior. Real-time monitoring and predictive analytics can prevent unauthorized transactions, protect consumer funds, and mitigate financial losses.

-

AI will use transaction data, device data, and customer information to identify patterns and anomalies that may indicate fraudulent activity. With the help of this real-time activity, fintech companies can easily detect fraud and prevent financial loss. Ai can also identify anomalous transactions, detect account takeover and payment fraud. AI is also used to develop a fraud detection model to determine fraud.

2.Ai in fintech industry for Risk Assessment and Credit Scoring

-

Lending decisions often involve:

- A complex assessment of creditworthiness.

- Evaluating an individual's financial history.

- Credit score.

- Behavioral patterns.

-

AI algorithms can analyze this data, predicting the risk of defaults with greater accuracy. This data-driven approach can inform responsible lending practices, reduce the risk of bad debt, and promote financial stability.

-

AI will use the customer's transaction data, personal data, and income-related data, and based on that, AI will generate the customer's credit score. With the help of this data, AI will also tell the customer about the risks of investing money.

3.Ai in FinTech industry For Investment Management and Trading

-

In traditional investment management, customers need to analyze multiple data and based on that they will choose the medium to invest. It is a very complex and time-consuming process. If customers collect the wrong data, then they will face a huge financial loss for trading. Customers need to analyze the data related to the company, profit and loss, and any considerable event that occurs in the company that might affect the reputation of the company.

-

With the help of AI in fintech industry, the whole analysis process becomes easy and less time-consuming. AI-powered tools can analyze market trends, economic indicators, and company performance, identifying undervalued assets, predicting market movements, and optimizing investment portfolios. This intelligent approach can enhance investment returns, minimize portfolio risk, and empower informed investment decisions.

4.Ai in FinTech Industry for Personalized Financial Recommendations

- It can be difficult for people to make wise financial decisions since they frequently entail complicated factors. AI algorithms may examine consumer preferences, spending patterns, and financial objectives to provide personalized financial suggestions, including investment possibilities, savings programs, and budgeting techniques. This tailored strategy may increase client involvement, empower informed decision-making, and increase financial literacy.

5.Ai in FinTech industry for Wealth Management and Financial Advisory Services

-

Investors faced advice and portfolios that were static and focused on past performance, not flexible enough to react to changes in the market in real-time. Time-consuming procedures for compiling pertinent financial data, designing customized investment plans, and modifying portfolios made it difficult to respond quickly in volatile financial markets.

-

With its ability to provide more individualized and nuanced insights, artificial intelligence is changing the face of asset management and financial advice services. Using AI algorithms, robo-advisors assess a client's financial status, investing objectives, and risk tolerance before providing personalized recommendations. This opens financial planning to a larger audience and democratizes access to individualized wealth management services.

6.Ai in FinTech industry for Chatbots and virtual assistance

- Traditionally, customer service has been labor-intensive, often leading to long wait times and frustrating experiences. AI chatbots and virtual assistants can revolutionize customer support, providing 24/7 assistance, answering queries, resolving issues, and offering personalized recommendations. This enhanced accessibility and responsiveness can significantly improve customer satisfaction, loyalty, and brand reputation.

- With the help of AI powered chatbots, customers can easily access customer services at any time. If customers have any queries, they will need to tell their queries to the chatbots, and the chatbot will give an accurate answer using the data on which it will be trained.

7.Regulatory Compliance with AI-Powered Solutions

-

Under the old approach, compliance officers had to shoulder the enormous burden of manually sorting through a never-ending maze of laws, policies, and regulations. This reactive strategy frequently led to a delay in responding to regulatory revisions, putting financial institutions at risk of noncompliance and possible legal action.

-

AI is intervening to lessen this load by automating compliance procedures. Machine learning algorithms can keep up with changing regulatory requirements, guaranteeing that FinTech businesses follow the most recent guidelines. This lowers the possibility of regulatory infractions and gives financial institutions more flexibility to adjust to shifting compliance environments.

Conclusion

- In conclusion, AI in FinTech industry is improving customer care services through chatbots and virtual assistants, enhancing fraud detection and prevention, enabling more accurate risk assessment and credit scoring, streamlining investment management and trading, and providing personalized financial recommendations.

How Digiqt will help you to adapt AI in your company

-

At Digiqt, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients with monthly updates on the software development progress.

-

Digiqt's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

What are AI In FinTech Industry?

AI In FinTech Industry are AI-powered systems that automate and optimize processes using machine learning, natural language processing, and intelligent decision-making capabilities.

How do AI In FinTech Industry work?

AI In FinTech Industry work by analyzing data, learning patterns, and executing tasks autonomously while integrating with existing systems to streamline operations and improve efficiency.

What are the benefits of using AI In FinTech Industry?

The benefits include increased efficiency, reduced operational costs, improved accuracy, 24/7 availability, better customer experience, and data-driven insights for decision-making.