AI For Sales Of FinTech Products:- 5 Ways To Implement AI To Modernize sales of fintech products

One such game-changer is the use of AI for sales of fintech products. AI expedites processes and enhances customer experiences

Introduction

- Innovative methods are necessary to keep ahead of the competition in the rapidly changing financial technology or fintech field. The application of AI for sales of fintech products is one such game-changer. AI improves client experiences and expedites procedures, which raises engagement and boosts revenue. In this blog article, we'll look at several approaches to integrating AI into fintech product sales, which will pave the way for a more effective and customer-focused future.

- With the help of AI for sales of fintech products, the company can generate multiple unique content to attract customers to purchase the fintech products, and they can design the unique content for the mail campaign. With the help of ai company can also segment the customers they can decide which type of audience they need to target and the ways to target the audience and also choose the ways to advertise the products.

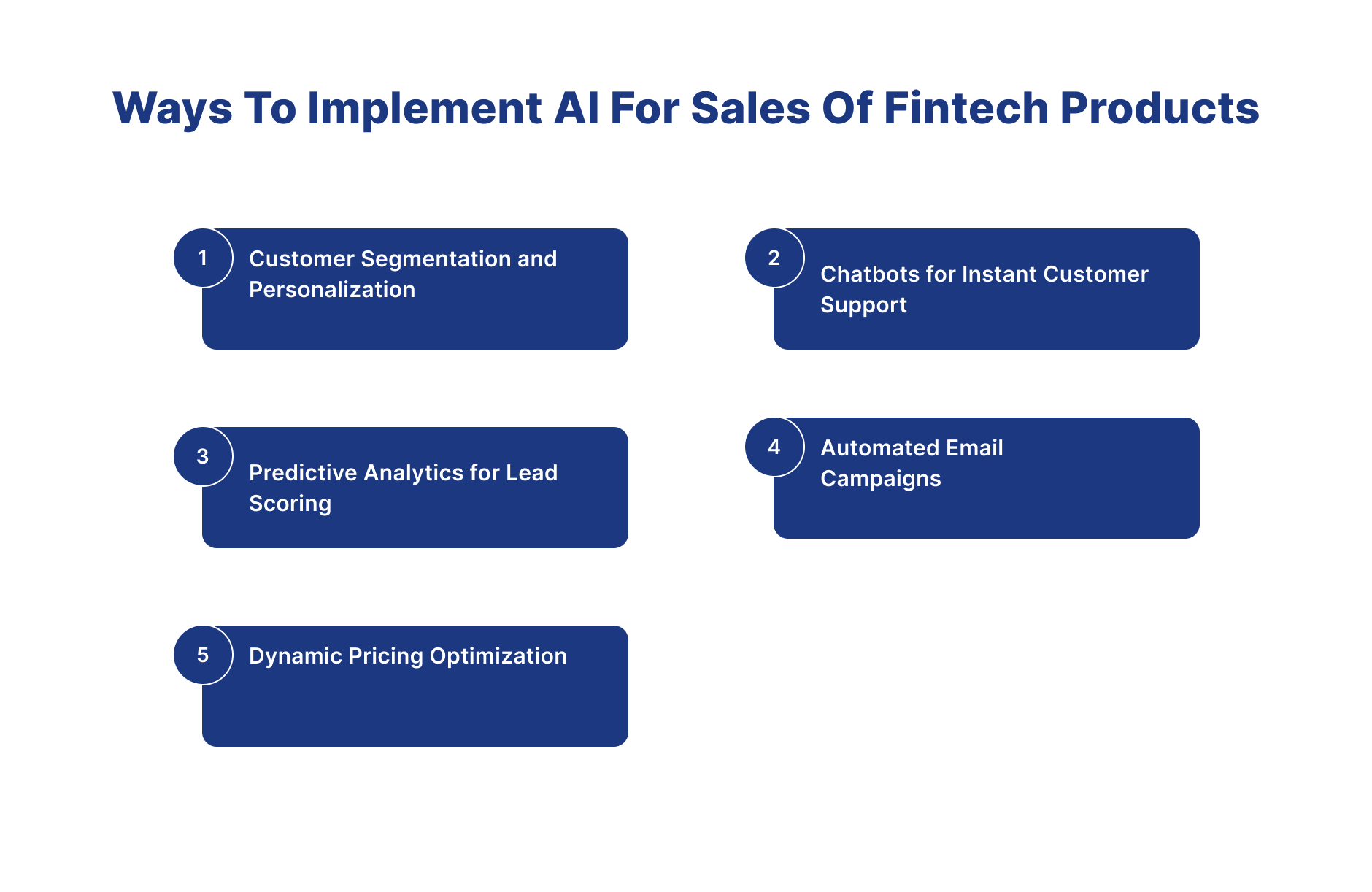

Ways to implement AI for sales of fintech products

1.Customer Segmentation and Personalization

-

In the traditional way to set the customer segmentation, fintech companies need first to collect all the data related to the customer, for example, which type of product customers purchase frequently. After that, the company needs to hire data analysis experts to analyze all the collected data and give it to the company. So, the traditional process of set customer segmentation is very costly and time-consuming.

-

But if fintech companies implement AI for sales of fintech products, then they can set customer segments and personalization. AI algorithms can find trends and patterns in consumer behavior, and artificial intelligence (AI) systems may examine enormous volumes of data. Fintech organizations may efficiently segment their audience and generate comprehensive client profiles by utilizing this information. Sales teams may provide a more personalized experience and boost conversion rates by customizing marketing messaging and product suggestions for particular groups.

2.Chatbots for Instant Customer Support

-

In the traditional way of customer support, FinTech companies need to hire an employee to listen to the query, and based on that, they will need to give a solution to the customer. Sometimes, employees can not understand the customer's query and will provide dissatisfied solutions to the customer. Companies also need to give training to the employees.

-

Integrating AI-powered chatbots may significantly improve customer assistance in the sales process. These chatbots can respond to standard inquiries, offer product details, and assist clients with the buying process. This promotes a more effective sales cycle by speeding up response times and allowing human salespeople to work on more difficult assignments. The company didn't want to give the training to chatbots every time. AI can provide 24/7 customer services, which means that if customers have queries, they can ask chatbots at any time, and it will give a satisfactory solution to the customer.

3.Predictive Analytics for Lead Scoring

-

In the traditional way of lead scoring, firstly, fintech companies need to collect data about the customer who has applied to purchase the product. Then, the expert will analyze the data, and on the basis of that, sales person will decide whether this lead can be covert or not. This process is costly because the company must hire experts to analyze the data.

-

With the help of AI for sales of fintech products, companies can use AI-driven predictive analytics to help sales teams prioritize leads based on their likelihood to convert. AI can provide a lead score to each prospective consumer by examining historical data and recognizing significant factors, such as prior purchase behavior and interaction patterns. By doing this, sales teams may maximize efficiency and closing rates by concentrating their efforts on prospects with the best conversion potential.

4.Automated Email Campaigns

- Email campaigns play a very important role in changing the customer's purchasing behavior. With the help of effective content, the company can convince the customer to click on the link to purchase the product. Designing the whole email campaign is very time-consuming, and the company needs to hire a professional to create it.

- AI for sales of fintech products can optimize email marketing campaigns Through consumer behavior analysis and content customization. Artificial intelligence (AI) algorithms may greatly increase the efficacy of email communication by suggesting related items and creating personalized subject lines. Fintech organisations may also employ automated email campaigns to routinely engage with their audience in order to nurture prospects and lead them through the sales funnel.

5.Dynamic Pricing Optimization

-

Pricing of the product can play a very important role in the survival of the product. If the product's price is very high, then the product will not survive in the market, and if the price is very low, then the company will not make much profit in the sales of the product. Product pricing can be decided on multiple factors like customer income, competitors' pricing, etc.. to determine this pricing, a fintech company must hire an expert, which will be very costly.

-

With the help of AI for sales of fintech products, companies can dynamically optimize pricing strategies using artificial intelligence (AI) algorithms, which can examine market conditions, rival pricing, and customer behavior. Fintech businesses can instantly change rates and provide customized promotions or discounts depending on the unique profiles of each consumer. Offering customized price options increases customer loyalty in addition to optimizing income.

Conclusion

- In conclusion, AI for sales of fintech products will automate all the sales-related processes, enhancing the lead generation process, customer support process, decision on the pricing of product process, etc. AI can reduce the cost of hiring experts in every department of the company. AI can also increase the company's profit by selling the right product to the right customer using analysis of a vast amount of data.

How Digiqt will help you adapt AI in the sales department

-

At Digiqt, we are dedicated to assisting companies in automating critical processes. Our highly skilled and professional team ensures the timely development and delivery of AI software. We commence by thoroughly understanding our client's specific requirements, and based on these requirements, our proficient team develops the AI software. Furthermore, we provide our clients monthly updates on the software development progress.

-

Digiqt's commitment to automation, client-centric software development, and regular updates ensures efficiency and effectiveness in streamlining insurance operations.

Contact Us

Frequently Asked Questions

What are AI For Sales Of FinTech Products?

AI For Sales Of FinTech Products are AI-powered systems that automate and optimize processes using machine learning, natural language processing, and intelligent decision-making capabilities.

How do AI For Sales Of FinTech Products work?

AI For Sales Of FinTech Products work by analyzing data, learning patterns, and executing tasks autonomously while integrating with existing systems to streamline operations and improve efficiency.

What are the benefits of using AI For Sales Of FinTech Products?

The benefits include increased efficiency, reduced operational costs, improved accuracy, 24/7 availability, better customer experience, and data-driven insights for decision-making.